…even though I prefer Bitcoin.

A lower “barrier of entry.”

I mention this in inverted commas because crypto, unlike exposure to stocks through most* brokers, does not require you to own an entire unit of said asset.

It’s practically non-existent in this space, as almost anyone can buy even just a tiny portion of crypto.

If this were the case for BTC (let alone crypto in general), multiple assets would become exclusively for institutional investors, the complete opposite of whom it was originally intended for.

Even though you can buy tiny fractions of BTC (satoshis) for a few dollars, some people – often newbies or anyone with little or no understanding of this asset class – still prioritise multiple units of altcoins or tokens over satoshis.

Owning a fraction of a bitcoin does not make your purchase any less valuable than if you were to spend the same amount on one, or many, altcoins.

CryptoVantage

I consider this a double-edged sword and, in my opinion, not the wisest move for the medium- to long-term.

However, I believe XRP is the exception here, as it is one of the few altcoins that has stood the test of time and remained a dominant force in space since its inception in 2012, three years after the advent of Bitcoin.

*Some entities permit people to purchase fractional amounts of shares, but several require individuals to buy an entire share, with many being out of reach for various retail investors. On the other hand, every exchange allows people to buy a tiny fraction of BTC (even just a few dollars) despite the asset being priced at roughly $25,000.

XRP is further from its all-time high than BTC

XRP failed to set a new all-time high (ATH) in 2021, unlike BTC, ETH, LTC, ADA, DOGE, and other crypto assets.

Its ATH of ~$3.80 has not been seen since the massive bull run of December 2017 – January 2018.

Of course, there’s no guarantee that it will ever return to that level, but the entire landscape has evolved considerably since then.

Even $1/XRP feels like a distant memory. XRP/USD price in green, and 24-hour trading volume in the greyish-blue bar below. Source: CoinGecko.

So why has XRP failed to return – let alone get close – to its ATH, despite BTC and other digital assets more than doubling their respective 2018 peaks?

A major reason for this is the Ripple vs. US Securities and Exchange Commission (US SEC) lawsuit, which is now over.

When the asset was stuck in regulatory limbo, it appeared to spook numerous would-be investors, whereas other digital assets were not in the SEC’s crosshairs, at least not at the time.

Now that XRP has this regulatory clarity and that Ripple Labs (the main entity behind the digital asset) has continued expanding its partnerships with multiple financial institutions across the world, I expect big things for this crypto – let alone across the entire market – throughout 2024 and 2025

Despite all of this, I consider BTC and XRP to be undervalued assets and believe both have a high probability of generating strong ROIs in the coming years.

“It’s too late to profit off Bitcoin.”

In other words, people missed the Bitcoin boat.

I do not believe this, as I still expect strong growth from the foundation cryptocurrency, whilst the ROIs won’t be as extravagant as those witnessed pre-2016.

Rather, Bitcoin still has plenty of room for growth, and I imagine it will continue outperforming other asset classes. I covered this in detail in this article I wrote last month.

Regardless of what’s predicted for the digital asset – notably, the elusive $1 million per BTC in the coming years – XRP still has plenty of appeal for prospective crypto investors.

“XRP has a lower market cap, so it has more room for growth.”

Yes and no.

Just because an asset has a lower market cap than Bitcoin, this does not necessarily make it a better investment.

BTC’s enormous MC – even eclipsing $1 trillion during the 2021 bull run – does not deter people from investing in this asset, which is widely regarded as the most decentralised cryptocurrency.

Unfortunately, the importance of Bitcoin’s high level of decentralisation is still unappreciated by laypeople, whether or not they’ve invested in this asset.

I expect that some would even prefer an asset affiliated with a company, i.e., XRP and Ripple, as opposed to Bitcoin’s anonymous creator and the misconceptions surrounding its network and others in this industry.

Despite The Magnificent Seven (formerly FAANG) stocks having enormous MCs, are average investors wanting consistent yet reasonable returns on their stocks deterred from investing in these shares?

No, there’s still plenty of demand for these.

Apple, in particular, currently valued at a whopping $2.73 trillion market cap, shows no signs of slowing down. It, alongside Amazon, Microsoft, Alphabet (Google) and several others, has consistently produced double-digit % growth for most years since the turn of the century.

Following the same logic, much of this applies to Bitcoin and even Ethereum.

Yes, banking on 50 or 100x gains in 12-18 months for large- or mega-cap cryptos is almost impossible nowadays. Yet, strong faith remains in these assets.

Ripple partnerships and XRP

The XRP Ledger (XRPL) appears to be the blockchain of choice for various companies, central banks and other entities wanting to improve cross-border payments or, in the former’s case, to run their planned central bank digital currencies (CBDCs).

As XRP is the native asset of XRPL, the crypto will benefit from dozens of major partnerships in the coming years.

Notable ones include:

– Taiwanese-based Fubon Bank*, Ripple Labs, is working with the Hong Kong Monetary Authority to launch a pilot program of their CBDC, the e-HKD. There is also a component of this collaboration relating to real estate tokenisation.

– Assisting Palau, a Pacific Islands nation, to launch their CBDC. Ripple expressed interest in partnering with New Zealand to roll out their upcoming CBDC.

– Working with Western Union, who started testing the use of XRP for cross-border payments in 2018. Recent articles reinforce this active partnership.

Ripple’s acquisition of a Swiss-based crypto custody startup, Metaco, for $250 million was announced in a press release.

https://medium.com/crypto-insights-au/crypto-watch-june-2023-xrp-dc0ce1ee2b88

Despite being separate from this cryptocurrency, more significant collabs between Ripple and corporations, government bodies, or other organisations will likely trigger bullish sentiment for XRP.

Per Bitcoin, it has been adopted as legal tender in El Salvador and the Central African Republic. I envisage that it will do well in the coming years, with more countries keen to use it as an official currency, not to mention business interest.

Despite this, I still believe that XRP has more potential upside, which leads me to my next point.

XRP total supply is deflationary (albeit very slowly)

Similar to ETH and BNB, fractions of XRP are burnt per transaction, gradually reducing total supply.

To protect the XRP Ledger from being disrupted by spam and denial-of-service attacks, each transaction must destroy a small amount of XRP. This transaction cost is designed to increase along with the load on the network, making it very expensive to deliberately or inadvertently overload the network.

XRP Ledger

For context, an XRP transaction fee is minuscule compared to other blockchains – perhaps one of the lowest out there.

At present, transaction fees start at 0.00001 XRP (with these subunits referred to as ‘drops’). This amount represents a fraction of a cent, and even 100 times that fee (at the current XRP price of $0.50) would be laughably small compared to other networks.

These cheap fees and ultra-fast transaction settlement times (typically in 3-5 seconds) make XRP more enticing than BTC, particularly for micropayments.

Having said this, Bitcoin will eventually have the Lightning Network in full swing, vastly improving transactions per second and transaction fees.

Furthermore, XRP is also burned in other circumstances – one being account deletion, which requires 2 XRP to be destroyed each time this occurs.

As a result, with greater adoption and more accounts being opened and closed over time, this will gradually lead to accelerated burn rates, thus bringing down XRP’s total supply.

However, before you get too ahead of yourselves, consider the following stats:

Circulating supply: ~ 53.1 billion XRP

Total supply: ~ 99.9 billion XRP

Max supply: 100 billion XRP

For perspective, this is well below the roughly 19 million BTC (capped at 21M) and Ethereum, slowly declining from its peak of 120 million ETH.

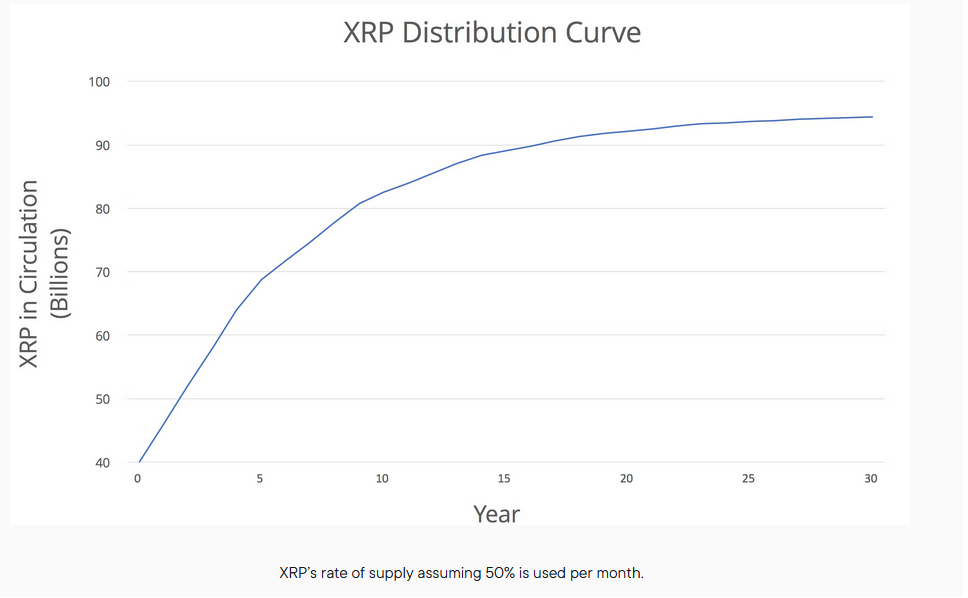

Notice that I mentioned total supply in the sub-heading instead of circulating supply. For some background information, the CS will continue increasing at a reduced rate for the coming years.

XRP CS over time, assuming that half of its supply rate is used monthly. Source: Ripple

Why is this? In 2017, Ripple Labs placed 55 billion XRP in an escrow, setting it up to release 1 billion coins each month.

Coins not sold during that period return to the escrow at the back of the queue (after the initial 55-month period).

Final thoughts

To reiterate, I believe BTC and XRP are good bets for the future. If I had to pick between the two for ROI from this point onwards, XRP’s lower market cap, any significant increases in adoption and deflationary mechanism could yield a higher ROI than Bitcoin.

Besides these, I anticipate many altcoins and tokens to benefit significantly from major BTC price rises, as the foundation crypto generally lifts their prices as it shoots up in value, and vice versa.

As the saying goes, “A rising tide lifts all boats”.

However, no one knows the future, and things rapidly evolve in this space, so I might hold a different view in the next three to five years.

Various detractors do not understand the need for smart contracts, decentralised money with controlled inflation rates, frictionless cross-border payments, a digital store of wealth, etc.

Moreover, many will continue hating crypto assets well into the future.

They will probably never understand the importance of blockchain technology, particularly permissionless (public) blockchains that cannot be shut down by any government, corporation or similar central authority.

In conclusion, whilst crypto prices are still subdued and we are yet to break out of this sideways movement (BTC has been stuck between $25,000 and $30,000 for most of this year), most crypto commentators and enthusiasts are banking on the start of a massive bull market shortly after the upcoming 2024 Bitcoin Block Reward Halving.

https://medium.com/p/2c25158339a3

Ways to stay in the loop with Ripple and XRP

– Official Ripple website and separate XRP page

– Whitepaper

– Twitter

– Ripple Insights – the official blog

– YouTube

– Reddit

– Telegram

– Discord

– Brad Garlinghouse

– David Schwartz

– XRP Ledger page (including Developer Resources)

– XRP Ledger Foundation (an independent, non-profit entity unrelated to Ripple)

– XRP LF GitHub docs

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs and other products affiliated with this space.

- For transparency, Bitcoin (BTC) accounts for roughly 20% of my portfolio; XRP makes up about 5%.

Featured image by leksiv on Shutterstock