How Profitable Is It?

With over 106 million BTC owners worldwide, countless examples of investing and trading strategies exist.

Scalping, arbitrage, leverage, high-frequency, swing trading, buying-the-dip, and lump-sum investing are notable ones.

However, there’s one that garners lots of attention and has been fairly successful for most people following this approach:

Dollar-cost averaging (DCA).

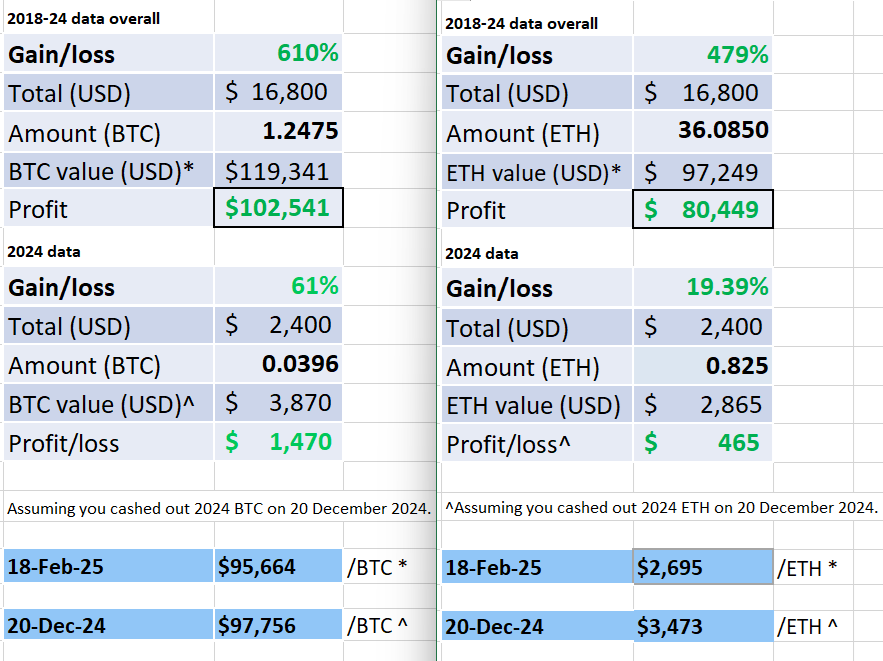

Today, we’ll analyse a DCA strategy for Bitcoin and compare it to Ethereum, seeing how the two have performed between January 2018 and December 2024, inclusive.

What is DCA, and why is it appealing to many?

DCA involves investing the same amount of money at frequent intervals (e.g., $200/month) over a given period, irrespective of an asset’s price.

It is preferred by people seeking a simplified approach to digital assets, let alone investing. This can be useful for beginners or risk-averse investors who are jumping into a market and need to understand technical analysis and macroeconomic trends.

Methodology and assumptions

– I took the closing prices of BTC and ETH on the 1st day of each month, based on statistics provided by Yahoo Finance.

This outlet also provides historical data for the ETH/BTC trading pair. I won’t cover this pair here, but I recommend tracking this occasionally as it can indicate crypto market trends (more on this in a future piece).

– I opted for a plausible figure of US$200 per month in each asset = $2,400 per year.

– There were 84 $200-per-month investments totalling $16,800 across the seven years.

– Returns on investment (ROIs) do not account for inflation, trading fees and other factors.

– I have rounded all the prices to the nearest dollar. Hence, there might be a tiny discrepancy between the listed and actual values.

Why 2018? This was the first full year after Bitcoin’s meteoric rise, let alone across the crypto market.

While 2017 was far from its most profitable year, the second half of that period marked the beginning of mainstream media coverage and overwhelming hype for this new asset class, as reflected by Google Trends data dating back to 2009.

I ran two hypothetical scenarios whereby:

1) On December 20, 2024, we cashed out each coin’s holdings for that year, let’s say, to take profits for Christmas.

2) On February 18, 2025, we converted all the BTC and ETH to calculate overall profits.

Results

While both performed very well, the winner overall was Bitcoin by approximately $22,100.

Had you followed the $200 per month strategy for the past seven years, the $16,800 would have turned into approximately $119,300 of BTC and $97,200.

Image supplied by the author.

The difference would be smaller when accounting for staking rewards, which I will elaborate on in the discussion.

I have included spreadsheets for Bitcoin (BTC) and Ethereum (ETH) for every table showing the annual DCA calculations, including the data and formulas used, so you can readily tweak it to match your circumstances.

Discussion/Additional thoughts

Many will point out that ETH has been eligible for staking rewards since the launch of the Beacon Chain in December 2020, marking the beginning of Ethereum’s transition to a wholly Proof-of-Stake network, i.e., The Merge.

I deliberately chose not to run a separate scenario, including staking rewards, as it would start to get complicated with the highly variable ETH staking APY, particularly with Beacon Chain’s first two years, when we were unable to withdraw native ETH until the “Shapella” Upgrade in April 2023. But I digress.

However, some people don’t realise that even though BTC doesn’t have staking rewards, it is still possible to earn a (variable) yield on your coins, which has been the case since January 2019.

How? Wrapped Bitcoin (WBTC).

This is an ERC-20 token pegged 1:1 to BTC. Operating on Ethereum allows this representation of Bitcoin to be traded on Ethereum DeFi protocols.

Aave is a renowned DeFi protocol that accommodates WBTC. Since 2017, it has allowed P2P lending and borrowing various crypto assets and stablecoins on Ethereum.

Major crypto exchanges are also adopting this idea. Coinbase recently launched cbBTC, which (at the time of writing) is only available via Coinbase Wallet, its non-custodial wallet, not its exchange, and DEXes that support it.

Binance also has its equivalent, BBTC. However, its price is highly volatile, most likely due to its very low 24-hour trading volume.

A handful of centralised exchanges allow clients to lend Bitcoin for a small return (1.5 to 2% p.a.), but this is still rare and can vary depending on one’s jurisdiction.

For the sake of this DCA comparison, I’d exclude exchange lending, as I would refrain from having 1.2 BTC use a custodial platform, but each to their own.

———————————————————————————————————————-

Restaking is another factor at play, allowing ETH holders to boost their staking rewards further to compensate for diminishing yield as a higher percentage of Ether is locked up.

EigenLayer is a popular example in this category. It allows holders to stake ETH across various platforms and simultaneously earn multiple protocol fees and rewards.

However, this process has risks and drawbacks, which you learn about here.

I considered comparing DCA and lump-sum investing, particularly mass sell-offs. However, this is far less predictable and not as convenient as DCA, which is more of a set-and-forget approach.

Even if the final result included staking via a liquid staking derivative such as STETH or RETH (Lido DAO or Rocket Pool, respectively), Bitcoin would most likely still be the winner.

In conclusion, when looking at the bigger picture, DCA is a timely reminder that small yet consistent efforts to invest money can go far, as is the case with many stocks, real estate and other traditional investments.

Which strategy is most appealing to you?

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. This is for educational purposes only. You are ultimately responsible for your investments.

- My opinions in this piece might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

- BTC and ETH account for approximately half of my digital asset holdings, about 25% each.

Image by kainashbabar at Freepik (AI-generated, unspecified base model).