Even though crypto assets and blockchain technology have come a long way since the advent of Bitcoin in 2008, the user experience (UX) is still far from ideal.

Many people don’t want to mess around with different chains, gas fees, bridges, checking wallet addresses and ensuring you’re using the right network, etc.

To onboard the next billion users, we must simplify crypto for the masses by making it as convenient as possible.

What are the solutions?

Enter account and chain abstraction.

While these are closely related, strictly speaking:

Account abstraction involves programming a blockchain account to operate as a smart contract, i.e., computer code automatically executed once pre-determined conditions are met.

Chain abstraction allows you to interact with dApps found across different blockchains, all with the same user interface (UI). In other words, the average person can easily carry out several actions across multiple blockchains without realising they’ve done so.

We’ll delve into chain abstraction (while also touching on account abstraction) and cover related crypto projects.

The current wallet model: Externally owned accounts (EOAs)

The current setup for non-custodial wallets is through a cryptographic keypair: public and private keys. This concept is called public-key (a.k.a. asymmetric) cryptography, which has existed since the 1970s.

While copying, pasting and confirming wallet addresses is straightforward for tech-savvy people, not everyone wants to go through this process when sending funds.

Then there’s another important step: The sender must ensure the funds are sent to the receiver on the correct blockchain network.

All of this is for just one transaction.

Fortunately, various developers have found a more convenient alternative.

A solution: Smart contract accounts (SCAs)

Rather than relying on an EOA to manage your account, a simpler alternative is to use smart contracts to operate on behalf of a wallet’s owner.

Some key advantages of SCAs include:

— programmability

— allowing another party to cover transaction fees

— transaction batching

— Access and recovery options similar to those for social media logins and other online accounts, such as multi-factor authentication, biometrics, security keys, email login, etc.

I also covered SCAs and account abstraction in a related piece published last year.

For a comprehensive overview of EOAs and SCAs, check out this post from Coinshift.

Related crypto projects

NEAR Protocol (NEAR)

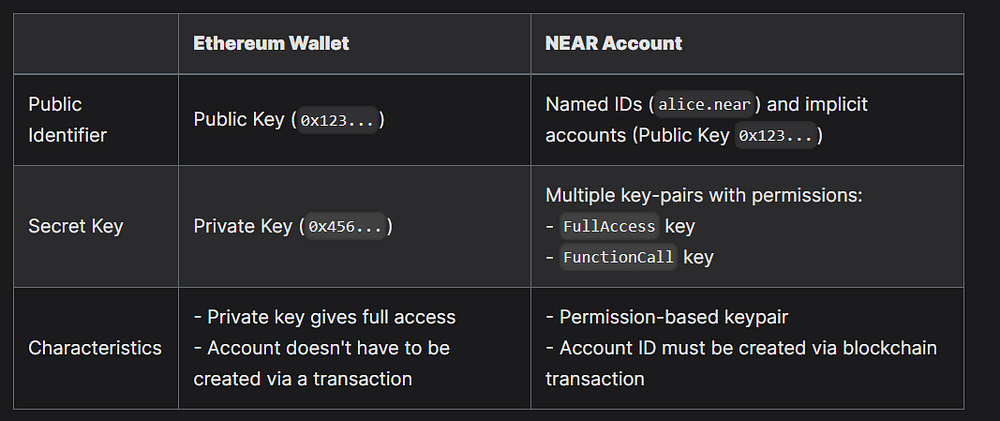

With personalised addresses (e.g., alice.near), 3.2 billion transactions under its belt, 10 million unique active accounts per month, a 100% uptime over the past four years, in addition to ultra-cheap and fast transactions, NEAR Protocol is one of the leading projects actively involved in chain abstraction.

Its native token is a top-30 crypto, with a circulating market cap of around $3.7 billion.

With this interoperability (with Ethereum, EVM- and non-EVM compatible chains) and greater flexibility overall, NEAR Protocol’s Chain Signatures are helping to create an improved cross-chain UX.

In March 2024, the project launched Chain Signatures, which allows users with a NEAR account to confirm transactions on NEAR-supported blockchains without relying on cross-chain bridges.

However, it’s still in its early days (let alone for chain abstraction in general), as only a few dApps have implemented this technology.

Source: NEAR Docs > Comparison to Ethereum

Chainlink (LINK)

Chainlink is a decentralised oracle network (DON) that allows smart contracts across several blockchains to connect with on- and off-chain data and readily connect to a range of distributed networks.

DON is a network maintained by a committee of Chainlink nodes. Rooted in a consensus protocol, it supports any of an unlimited range of oracle functions chosen for deployment by the committee.

Chainlink 2.0 whitepaper, April 2021

It can facilitate connections to multiple APIs and services through blockchains, such as Bitcoin, Ethereum, Cardano, and Polygon.

Additionally, Chainlink is further enhancing connectivity by improving one of its key products, the Cross-Chain Interoperability Platform (CCIP).

As an ERC-20 token, it has been operating on Ethereum since its launch in 2017.

Cosmos Hub (ATOM)

The Cosmos SDK is an innovative blockchain framework that underpins Cosmos Hub, a.k.a. Cosmos. It allows for the creation of custom blockchains and the connection with existing ones built on the Cosmos Network via the Inter-Blockchain Communication Protocol (IBC).

Cosmos allows for transferring non-fungible tokens between IBC chains while maintaining non-fungibility and asset ownership, among other benefits.

This involves ICS-721 tokens, which work with current standards such as ERC-721 tokens on Ethereum.

Valence, a cross-chain project, builds on the IBC’s functionality by connecting with other systems, such as Bitcoin L2s, Ethereum protocols, and Solana DAOs. It also supports restaking services offered by Cosmos Hub, EigenLayer and similar entities.

The Cosmos SDK is also the basis for Router Protocol, a Layer-1 chain designed for facilitating communication between various ecosystems.

.

Polkadot (DOT)

Considered a “Layer-0” blockchain, Polkadot promotes itself as “a scalable, interoperable and secure network protocol for the next web (Web 3)”.

To achieve this, there are three core components of its main blockchain architecture: the relay chain (the network’s core chain), parachains (Polkadot-native chains) and bridges (ideal for interacting with different networks such as Bitcoin and Ethereum).

I recommend exploring its lightpaper for a concise overview of its blockchain and use cases.

Additional thoughts

EOAs will likely stick around for decades even as SCAs become more common.

While SCAs are more convenient, there’s always a risk of code being flawed or compromised.

The most common vulnerabilities fall into these three categories:

— Operational risk: Problems with access or authorisation

— Implementation risk: uncertain transfers, false signatures and unapproved connections to dApps

— Design risks

To learn more about these potential issues, check out this guide from QuickNode.

Nonetheless, some in our society wouldn’t be bothered by the relatively higher (albeit low) risks if it means simple account logins instead of time-consuming processes and the extra steps associated with EOAs.

I am all for giving people options rather than being forced to use EOAs or primarily rely on a centralised exchange.

As identified by the Crypto Council for Innovation, chain abstraction will be a slow and complicated process when factoring in the need to ensure a smooth transition from one chain to another.

Moreover, there’s a need for collaboration between developers across different blockchains, which has been wishful thinking over the years.

Even though this piece has focused on providing a much better UX, chain abstraction also involves improving the developer experience when dealing with different ecosystems.

Despite the intense competition between several L1s and L2s, maintaining secure and sufficiently decentralised networks remains the priority, particularly with blockchain security.

The Internet’s current state was achieved through decades of R&D, with plenty of trial and error. Distributed ledger technology is also experiencing teething issues to eventually create an amazing and efficient user experience.

“Imagine if a Gmail user couldn’t just send a message to an Outlook address — it doesn’t make sense. The same is true for Web3 addresses. The core assumption of chain abstraction is: end users don’t care about the underlying blockchain. They just want apps to work.”

Illia Polosukhin (NEAR Co-founder) via the Near Protocol blog > Why Chain Abstraction Is the Next Frontier for Web3

Considering how far this industry has come with the explosion of new ecosystems since 2017, I remain optimistic about how much further it will progress by the turn of this decade.

How much impact do you believe chain abstraction will make in the future? What other improvements are you looking forward to seeing in the coming years? Leave your thoughts below.

P.S. Many other blockchains cover interoperability in their whitepapers, so this and CA are not exclusive to the abovementioned protocols.

Further reading

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

•Ethereum (ETH), Bitcoin (BTC) and Cardano (ADA) collectively account for about 65% of my crypto portfolio in order of holdings.