Brace yourselves for a wild ride.

Much of the excitement has been around Bitcoin in recent months with an imminent Spot ETF and its upcoming Halving event, but let’s not forget the part of this asset where people are making life-changing gains in just a year or two.

Yes, it’s even riskier than Bitcoin and Ethereum, but we’re here to give it a go or die wondering.

Which altcoins and tokens can realistically do 80 to 100x in the next two years, plausibly within 12 months?

I’ll give myself two years here because many anticipate a lengthy bull run that will start shortly after the Bitcoin Halving (most likely this April) going well into 2025.

Before beginning, a quick run-down of the considerations to make:

– There will be eight micro-caps (between $50M and $100M in circulating market cap) and two small caps (approximately $120M and $250M CMC, respectively).

– All should have a high-security score ≥80, as per Moralis Money and DEX Tools’ metrics (more on these towards the end), to help us determine whether a crypto project is legit or not.

– Their social-media presence and developer activity is additional food for thought.

Let’s begin.

____________________________________________________________________________

Swarm Markets (SWARM) – ~$17.5M circulating market cap, ~$0.28 per token, $1.09 ATH

If there’s any project on this list that I am most excited about, it is this one.

Swarm Markets allows people to trade public stocks, tokenised bonds and other assets on-chain. Eventually, this will expand to other tokenised and fractionalised assets (more on these shortly).

This is one example of what I was alluding to earlier with “seamless experience.” Not only are we looking at a future we can easily swap between assets on different blockchains, but readily going from crypto to shares takes it all to the next level.

How is this achieved? Swarm Markets has taken a leaf out of the playbook for liquid staking derivatives by using so-called “liquid stock tokens”, which are all reportedly “100% real-equity backed.”

I see three major benefits from this setup:

1) Retail investors can easily bypass registering for separate trading platforms to deal with popular stocks. However, I admit that Swarm Markets is unlikely to have the same number of stocks that a designated brokerage firm would have, at least not initially. Nonetheless, many major publicly traded companies are available.

2) It avoids duplication of KYC AML checks, being able to manage all (at least, the vast majority of) investment vehicles all in one place — no need to show ID for different platforms.

Swarm Markets onboards its users through their Passport system, containing verified personal details, trading balances, connected Ethereum addresses, etc.

3) If Bitcoin, Ethereum and altcoins/tokens have managed to create a system where you can easily own the tiniest fraction of crypto, sooner or later, there will be a system where you can easily trade fractions of stocks instead of buying whole amounts.

Tokenised real estate, anyone? It will become mainstream sooner than you think.

Image by benzoix on Freepik

The concept of tokenising assets is sometimes referred to as asset fractionalisation.

As a common example, imagine a piece of prime real estate that can be divided into 100 equal portions using blockchain tech, and multiple owners can own varying amounts of portions.

Why stop at real estate? Let’s not forget art, classic cars, NFTs…you name it; it will, over time, be managed with distributed ledger technology and AI through automated processes.

This will be a significant space to watch, particularly as smart contracts platforms improve, such as having cheaper and faster transactions.

The most exciting prospect here is the sheer size of what’s forecast in future: In a related report from Boston Consulting Group, its authors anticipate a whopping $16 trillion of tokenised assets by 2030, possibly up to $68T in a best-case scenario.

Before moving on, what’s SWARM’s role in all of this? It acts as a payment token for the network and incentivises network participants to use it by providing discounted fees, facilitating transactions and other rewards. It is akin to using BNB or related services when trading on Binance.

___________________________________________________________________________

Hello Labs (HELLO) – $92M circulating MC, $0.14 per token, $0.16 ATH

Don’t let its more than 20x performance in 2023 put you off from even more growth; this is still a micro-cap…and I believe it’s just getting started.

As per its website, this protocol is a “Web3 native ecosystem that incubates, produces, funds and distributes original programming, games and NFT.”

Hello Labs offers two main products: Hello TV, its video-on-demand service, and Hello Arcade, its gaming division, with two games currently: Doge Dash and Dash of the Dead. For these games, participants can earn HELLO Credits as rewards.

One of the featured programs on Hello TV is Killer Whales, the crypto equivalent of Shark Tank. This new show includes Austin and Aaron Arnold, behind Altcoin Daily, one of the largest and most reputable crypto YouTube channels.

It was founded by Paul Caslin, a Grammy-nominated Creative Director. Austin and Aaron recently interviewed him earlier this year to discuss Hello Labs, Killer Whales, NFT and more.

I am excited about the HELLO token continuing its rapid adoption going into 2024, perhaps at an even faster rate.

Why is this? We witnessed the overwhelming success of gaming tokens in the 2021 bull run:

– Axie Infinity pulled off ~300x in less than 12 months (50 cents in January to $160 in November that same year).

– Gala Games (GALA) somehow generated 700x (yes, you read that correctly) in 2021, going from $0.001 on 1 January to $0.70 in November).

Point of the story: Don’t rule out HELLO and other tokens involved in content creation and gaming from achieving a solid 80-100x by the end of 2025.

Yes, it’s not a 700x in the space of 11 months, but let’s not get too greedy. Don’t forget to take some profits here and there.

If Hello Labs continues to expand its scope – which I strongly believe it will – by adding more games and shows and eventually adding an NFT division to its repertoire, then HELLO will have the top 50 in sight within 12-18 months.

____________________________________________________________________________

BOLT (BOLT) – ~$5M circulating MC, ~$0.0053 per token, $0.04 ATH

Why just one Web3 media platform, i.e., Hello Labs, when we can explore another Web3 entertainment option on this list?

Bolt has emulated the play-to-earn model with its entertainment options by adopting a watch- and share-to-earn system for its participants.

Regarding recent news and partnerships, a major component of its streaming service is its collaboration with a major football (a.k.a., soccer, for you Americanos) media enterprise, OneFootball.

“It’s through One Football that we’ve been able to deliver such valuable and never-seen-before content from high-profile clubs. So this renewal represents a firm commitment on our part to ensuring that Bolt+ remains the go-to destination for football fans who want to celebrate their passion for the beautiful game.”

Bolt Global blog post, 14 November 2023.

OneFootball covers content for some of the biggest football clubs in the world across major leagues such as the English Premier League, La Liga (Spain), Bundesliga (Germany), UEFA Champion Leagues and more.

Rest assured, they cover more than just sports. Bolt has also collaborated with Chingari, an India-based short video entertainment platform. This platform also incentivises activity via its network token, Gari.

By now, I imagine you see the common thread. Various services are finding ways to encourage people to get involved in using their services. Whether through gaming, streaming, sharing or dealing with NFTs, earning tokens is the new norm. Thus, it will become an expectation someday if it hasn’t already.

Stay in touch with the project through X (Twitter) by checking out Bolt+ and BoltX wallet. I recommend following the Bolt Global Medium page for the latest news and partnership updates.

____________________________________________________________________________

Dimitra Token (DMTR) – ~$15M circulating MC, ~$0.03 per token, $5.95 ATH

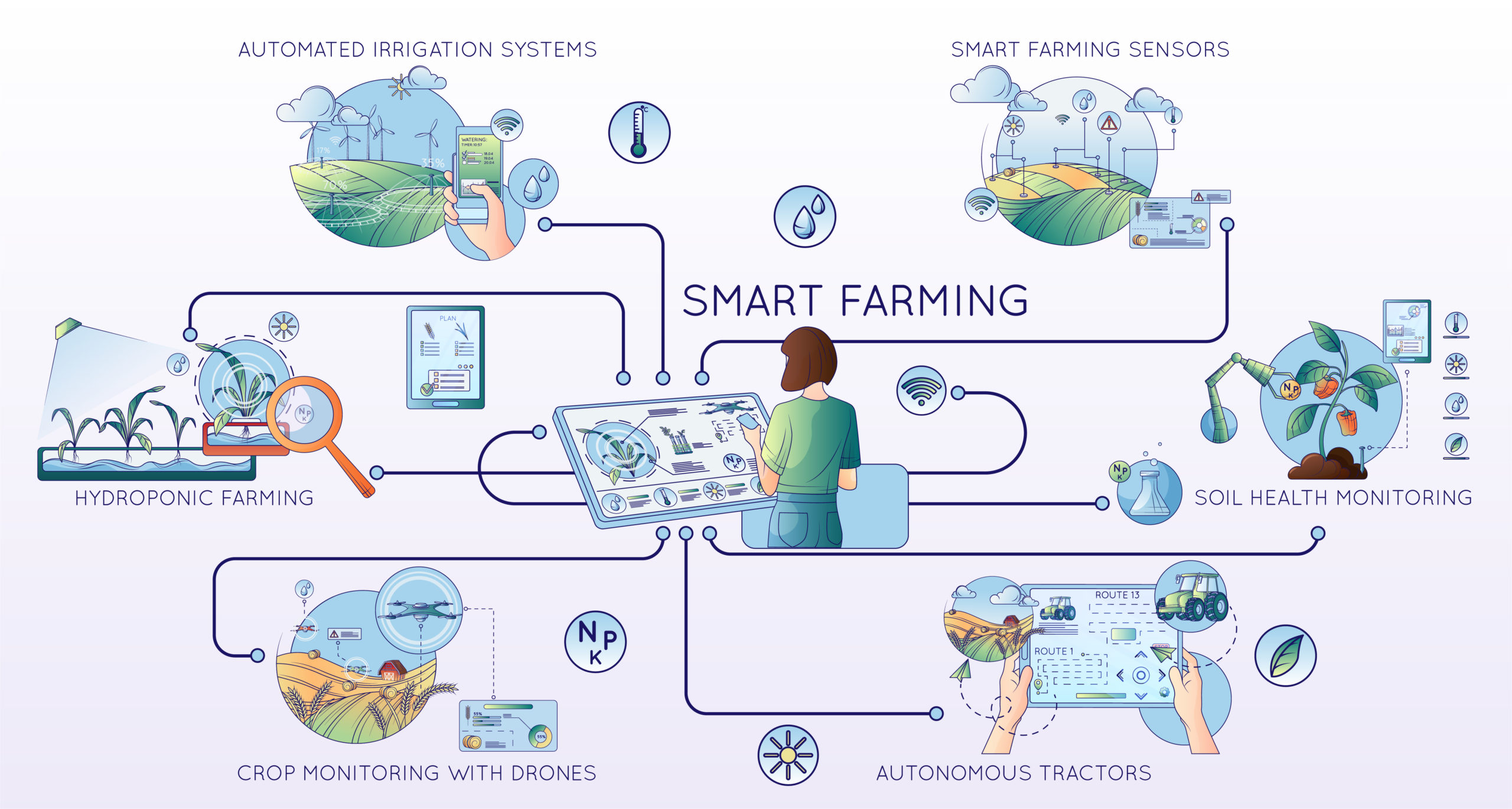

Using blockchain technology, Dimitra is teaming up with government departments, NGOs and for-profit entities to help smallholder farmers improve their crop yields and overall productivity by harnessing a range of modern technologies.

Some notable collaborations include:

– Being awarded a contract from OBC Indian Chamber of Commerce, Industries, and Agriculture to utilise Dimitra’s ‘Connected Farmer’ app across 1.2 million farms in the world’s most populated country.

– Working with the Brazilian Association of Fruit Producers and Exporters to help its members improve efficiency in domestic fruit farming, logistics and exports.

– Partnering with the Ugandan National Animal Genetics Research Center (NAGRC) to improve genetic diversity and welfare for farmers’ animals and better market access for selling their products. More info here.

With a growing global population and billions of people across poorer regions needing a significant boost in overall nutrition, there is major potential in reconciling agriculture and these innovative technologies.

The Dimitra platform is built on blockchain technology and incorporates mobile technology, machine learning, IoT devices, satellite and drone imagery, genomics, and advanced farming research.

Equipping all farmers with (at least some of) these tools will help provide greater resilience to cope with the highly dynamic nature of agriculture. I understand that some of these are prohibitively expensive for many small-scale farmers, particularly in developing regions.

However, with improved access to communications tech and greater transparency and efficiency through blockchain technology, these will become more accessible over time.

DMTR is the project’s native token operating on the Ethereum blockchain. You can track its tokenomics through the following sources.

– Etherscan

– Dimitra tokenomics tab

– Moralis Money

– DEX Tools

Image by macrovector on Freepik

____________________________________________________________________________

OriginTrail (TRAC) – Circulating MC ~$211M, currently $0.52, ATH ~$3.71

This is the first small cap for today’s list. Despite the relatively higher market valuation, this still has plenty of upside.

Product traceability, logistics tracking, security audits, sustainable agriculture and verifying credentials using blockchain technology to ensure their authenticity are some of the leading solutions that OriginTrail has deployed.

Its developers and other stakeholders are continuously working to achieve greater efficiencies for various stakeholders across the globe by improving the technology and fostering new partnerships across different sectors.

These only scratch the surface of what the organisation has achieved and what is planned; you only need to look at its comprehensive roadmap with its five eras (similar to Cardano) to see what is in store for its ecosystem. Check OT’s whitepaper for details about its dual-token system and layer 2 solution (OriginTrail DKG).

Another crypto with some similarities (in terms of solutions) is VeChain (VET), which will also do well in the future and benefit from more investment across the crypto space. IOTA is also a candidate, but I would prefer TRAC and VET if I were to bank on a better ROI in this bull cycle.

So why do I believe TRAC, VET, or similar assets will do very well in future? Because the use cases, especially those about product traceability (for food, alcohol, vaccines, etc.), verifying credentials (e.g. university degrees, thinking of countries with sub-par record keeping), or confirming the authentication of (luxury) goods to combat counterfeiting, are all possible (and will become mainstream) by utilising blockchain technology.

Image by Satheesh Sankaran on Shutterstock

____________________________________________________________________________

MAP Protocol (MAP) – ~$120M circulating MC, ~$2.49 per token, $22.67 ATH

This initiative positions itself as a Bitcoin layer-2 network, aiming to improve the pioneering blockchain’s interoperability significantly.

This will become increasingly important as part of the enormous drive to on-board billions of users around the globe and offer them a seamless experience when interacting with crypto assets across different blockchains (and other distributed ledger networks such as Kaspa, IOTA, Hedera, etc).

As a quick digression, I want to reiterate that interoperability is not just a buzzword.

“When it comes to blockchains, interoperability is not just a buzzword. It’s a quintessential factor driving the trajectory towards a more connected and inclusive crypto ecosystem.”

Out of all the major networks, Bitcoin will benefit the most from this. Moreover, I imagine MAP Protocol will be one of many projects helping it improve cross-chain communication.

Earlier this year, I covered Stacks, another Bitcoin layer 2. It has been one of the best-performing top-100 altcoins/tokens this year, up by 400%, 2.5 times more than BTC’s gains year-to-date.

Thus, I am excited about MAP Protocol’s prospects going into 2024. As the overall crypto space continues to grow in many ways – daily active users, volume traded, increase in circulating market cap, etc. – this project should work its way up the ranks, most likely generating an even higher ROI than Stacks in 2023.

Image by Panchenko Vladimir on Shutterstock

____________________________________________________________________________

BOB (BOB) – ~$43M circulating MC, ~$0.000061 per token, $0.000219 ATH

This wouldn’t be a highly speculative list of micro- and small-cap tokens without featuring a meme coin.

I present to you, BOB.

In early 2021, how many people expected the OG meme coin, DOGE, to hit roughly 69 cents from being less than a penny on 1 January?

SHIB went nuts and generated a mind-blowing 100,000,000% ROI for its holders between August 2020 and November 2021.

BOB is one of many meme coins running on Ethereum and appears to be a spin-off of PEPE. As this is still a fairly new token, I expect this to ride the wave of meme-coin mania that (some will say) has already started.

Now that BONK – a Solana-based meme coin – is going ballistic, its holders will eventually take profits and aim to invest the funds into another protocol, most likely a no-name meme coin.

Whether you like it or not, a cohort of crypto investors is obsessed with meme coins, a.k.a. “community coins,” to put it euphemistically.

I opted for BOB due to the higher security (DEXT) score and stronger alpha metrics (net experience buyers, buy pressure, holders, etc.) than other tokens in this category, ensuring it has a low market cap.

WOOF – an alternative pick that runs on Solana – has a lower-than-ideal DEXT score of 62/99 (as opposed to 80/99). I’ll let you be the judge and implore you to research this.

One last thing about meme coins, let alone for any (lesser-known) project: It is important to check the token contract (see below) to ensure that what you’re allocating money to corresponds to the correct project. This is essential when dealing with a decentralised exchange, where you can use almost any token, even the non-legit ones.

The token contract provided by a reputable price-tracking service usually provides the correct token contract with the logo of the corresponding layer-1 chain (i.e., Ethereum, in this case). Having said this, you are ultimately responsible for your investment. Source: CoinMarketCap (arrow added by the author).

________________________________________________________

MurAll (PAINT) – $5M circulating MC, $0.004 per token;

MurAll is a 2048 x 1024-pixel digital collaborative mural/canvas on the Ethereum blockchain.

Any artwork made on this wall lives on the blockchain for as long as it is functioning. As this is Ethereum, I doubt it will go away anytime soon.

For each drawing made on MurAll, you will receive a MurAll NFT, allowing you to freely hold, display or trade your work.

This ERC-20 token has generated a massive 1,600% ROI in 2023.

This project has been around since 2020, so it is not a random project that has sprung up out of nowhere.

Shortly after launching, it hit an all-time high about 9x from its current price.

It has a fixed supply of 22,020,096,000 tokens. As this is the pre-mined amount, no new tokens can be created. On top of this, it costs 0.5 PAINT per pixel.

“Unlike some other collaborative drawing projects, you do not own the pixels you draw over on MurAll so someone else’s drawing can be drawn over. However, no one can draw on your MURALL NFT which contains your original drawing on MurAll. The fact that MurAll can only be covered in its entirety a maximum of 21 thousand times means that people will think twice about redrawing other people’s work.”

This also adopts a token-burn mechanism to reduce its supply. Similar to other projects, PAINT tokens used to draw on MurAll’s canvas are removed from circulation.

Whilst the price is still a fraction of a penny, this might not always be the case. Here is some food for thought when considering PAINT’s price prospects:

The NFT craze in 2021 coincided with the market-wide bull run. Moreover, artists and general enthusiasts will be keen to explore MurAll and other platforms, allowing them to produce top-notch work for a relatively lower price (whilst PAINT tokens are very affordable).

Having more platforms for creative types will only encourage them to produce even more artwork for a range of enthusiasts.

Image by felipemihran on Freepik

____________________________________________________________________________

Energy Web Token (EWT) – ~$120M circulating MC, ~$2.49 per token, $22.67

This not-for-profit, based in Zug, a.k.a. Switzerland’s Crypto Valley, aims to create and deploy open-source Web3 products that allow companies to benefit from clean and distributed energy systems.

For brevity and to avoid repetition, I will touch on some points I covered in a comprehensive run-down of this article in an article from February.

https://medium.com/crypto-insights-au/crypto-watch-february-2023-energy-web-token-ewt-3202703d4f26

Three major components of Energy Web include:

Green proofs: These can help verify electricity provenance for renewable energy in electricity markets (especially for determining RE sources and % to power EVs), more eco-friendly Bitcoin mining and the aviation sector, with a push for sustainable aviation fuel in the coming years.

Data exchange: EW Data Exchange facilitates information flow and processing between various players, avoiding the need for a central entity. Energy Web claims it can work on “any protocol, any use case, all with a single integration”.

Asset management: This component covers EW’s Asset Management to provide immutable and powerful audit trails to verify every step across an asset’s life cycle, accurately monitor the operating status, and access authorisation for numerous devices across a distributed network.

Check out this GitBook entry regarding EWT tokenomics. There is also this Energy Web article covering ways to stake your tokens.

This is the second and final small cap for today’s list.

Logo courtesy of Energy Web media kit

___________________________________________________________________________

Landshare (LAND) – ~$5.5M circulating MC, ~$1.43 per token, $12.19

Rounding off this list with another land-tokenisation crypto asset is Landshare and its corresponding token, LAND.

Landshare aims to reconcile DeFi and the real estate industry by providing universal access to this asset class. This also includes real estate NFTs and the ability to profit off house-flipping from as little as $50.

Quick side note: I know that people have their own opinions about the ethics of this practice. However, I am here to promote this project and inform you about the available options.

The protocol runs on the Binance Smart Chain (i.e., BNB Chain). So, for anyone wanting to buy the token, your best bet is to use Binance-related DEXes, which are compatible with this blockchain.

Per LAND, it hit its ATH in the last market-wide bull run; I believe the token can further capitalise on its 2023 gains so far (173% YTD) and will go into 2024 with market-wide bullish momentum, possibly getting its price into the double-digits once again.

Please check the About page of the project’s website, as it states that some features are unavailable for people across certain jurisdictions, including the USA.

To avoid repetition, much of what I mentioned about the tokenisation of assets earlier is applicable here to Landshare. Many companies and their utility tokens will benefit immensely from this new type of investment, so watch this space.

To dive deeper into Landshare, visit the Landshare Docs page (via GitBook) and check out its whitepaper.

LAND rates very highly on Moralis Money and DEXT Tools’ security scores.

___________________________________________________________________________

Final thoughts

– There will be other promising altcoins and tokens that I could have featured on this list. I opted for ten choices for brevity and to avoid bombarding you with info.

– It is possible that I didn’t follow the best methodology by emphasising security-score metrics. Nonetheless, I advise extra caution when dealing with unpredictable tokens.

– After all, 95% of your money invested in this asset class (IMO) should be focused on BTC, ETH and a few other mid- to large-caps. Any massive windfalls from micro-caps can be converted into BTC, ETH or other large-caps to boost your holdings.

If you had minimal exposure to these highly risky tokens I have featured here, then losing it all is no biggie. However, if you sit on the sidelines and these do an 80-100x, I know that you dwell and ruminate over what could have been.

– As a reminder, whilst these micro-cap assets offer incredible ROIs, it is also likely that you would pick some that could collapse in value. Higher rewards = greater risk.

– Regarding BOB and micro-cap meme coins at large, expect them only to get so high before people transfer profits to another unknown meme coins, and repeat the cycle along the way.

– When taking profits, consider what portion you want to convert into a fiat currency (e.g., USD, EUR, GBP) and what percentage to take in BTC or ETH. I have an article covering this in detail.

– For a useful guide about how to find reputable micro-cap altcoins and tokens with significant growth possibilities, check out this recent video from Ivan on Tech.

– Seeking opinions from various independent sources (ideally, at least three separate sources) will increase the likelihood of getting sound advice. This is essential if you plan to invest a lot of money into a project.

– Some of this research should include reviewing company news, whitepapers/lightpapers, opinions from renowned and experienced crypto commentators, taking note of major partnerships/collabs, etc.

What are your favourite tokens? What do you think of this list? I look forward to your feedback in the comments section.

Disclaimers

– None of this is financial advice, and I am not a financial advisor. I take NO credit for any successful guesses here, just as I have ZERO liability for any losses you incur by investing in any assets listed herein, let alone those I have mentioned over the years.

– The opinions expressed within this piece are my own and might not reflect those behind any project listed here.

– Please DYOR before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

– I hold a small amount of TRAC and BOB, collectively accounting for about 1-2% of my overall crypto portfolio.

– I received no incentive from companies, individuals or entities listed throughout this article to discuss their product.

– Most price data were obtained on 16 December 2023 (unless specified otherwise), with rounding used for brevity.

Thanks for your support.

Image credits

Featured image by phive on Shutterstock. Image text: ‘Blade Runner Move Font’ by Phil Steinschneider. Check out Phil’s other great fonts here.