So don’t mess this up.

“It’s too late to invest in crypto.”

Straight up BS…for the most part.

I’m getting tired of hearing this superficial claim.

Yes, it’s less likely you’ll see the explosive gains in quick succession that we experienced up to 2017*.

However, it doesn’t mean it’s “too late”. You need to be more savvy about preparing to have dry powder ($$$) available to take advantage of abrupt dips (even bull cycles have many of these, as we’ve seen since Trump’s inauguration as recent examples) and to take some profit when the market gets overheated.

*If you bought at the bottom of the market crash in March 2020 and sold at the market’s local peak around October or early November 2021, this still applies, to a certain extent.

————————————————————————————————————————–

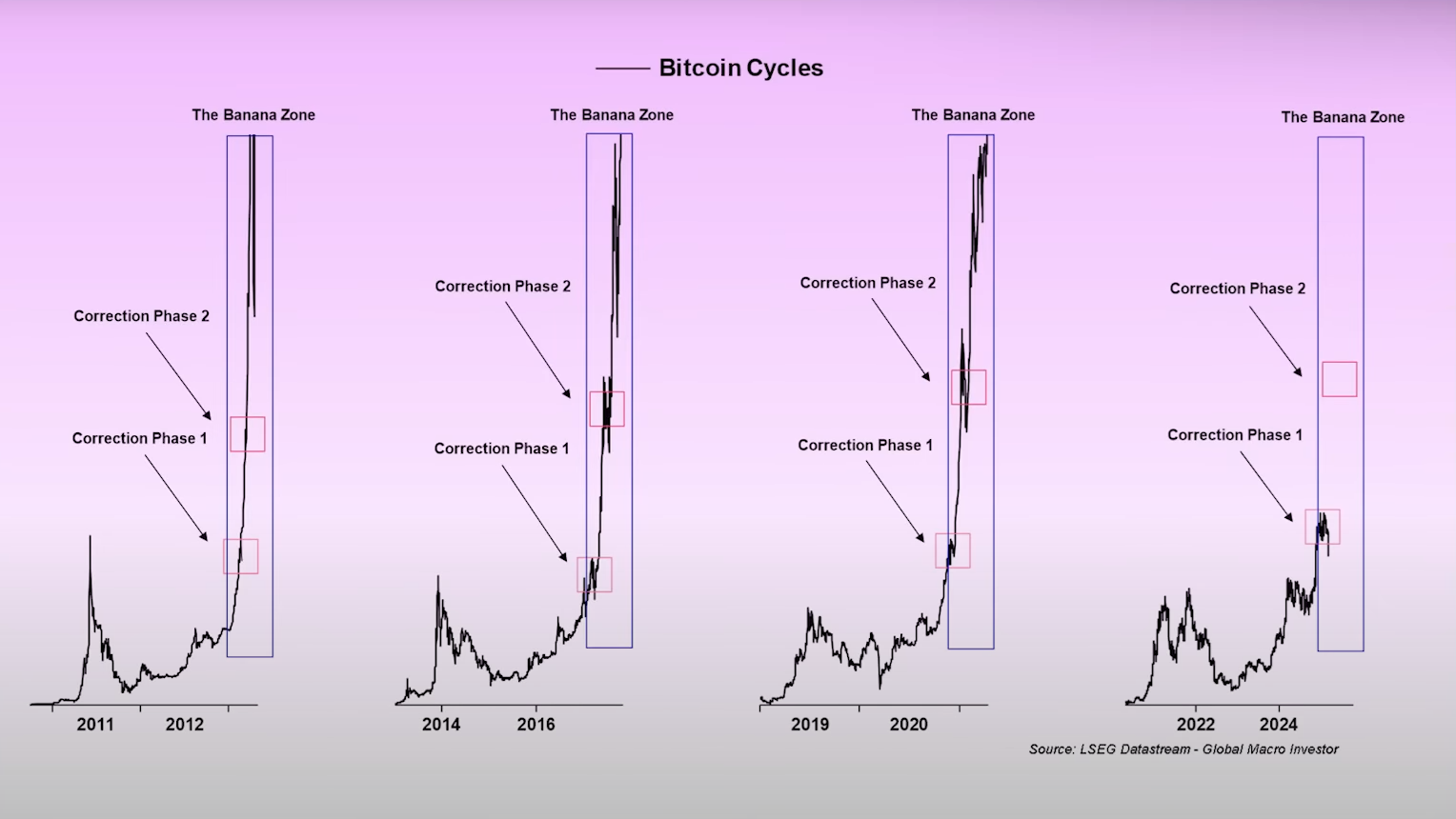

Raoul Pal, a renowned macro investor and CEO of Real Vision, frequently speaks about the ‘Banana Zone’, a period of rapid, sharp growth in BTC prices that often leads to other digital assets going parabolic and eclipsing their all-time highs.

Earlier this month, Pal published a video providing a macroeconomic update and his forecasts for Bitcoin, Solana, Ethereum, and the rest of the space, including the related Banana Zone chart. Here’s a screenshot illustrating this.

Screenshot obtained from Raoul Pal The Journey Man > URGENT Update: Time To Sell My Crypto?, 1 March 2025.

Special thanks to The Daily Hodl for bringing this to our attention.

History doesn’t always repeat but it often rhymes.

With all the institutional adoption (12 spot ETF providers managing over 1.1 million BTC), other firms worldwide accumulating BTC and the US Strategic Bitcoin Reserve since the last bull run, I find it hard to believe that Bitcoin will remain below $100,000 for much longer.

Even though many doubt BTC will perform as well as previous cycles due to diminishing returns for each bull run, the maturation of this space, Trump’s announcement of a ‘Crypto Strategic Reserve’ involving XRP, SOL, ADA…then BTC and ETH, and the US SEC dropping crypto-related lawsuits, there are high hopes of seeing a continuation of this post-election market-wide bull run.

For years, we were able to front run corporations and governments, but I’m afraid those good olde days are long gone.

Still, in terms of missing the boat on crypto, while we’re starting to reach the point where there’s an inkling of truth, it’s a misleading claim nonetheless.

How? This image puts things into perspective:

𝐆𝐫𝐚𝐩𝐡 𝐨𝐟 𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 𝐑𝐚𝐭𝐞 𝐂𝐨𝐦𝐩𝐚𝐫𝐞𝐝 𝐭𝐨 𝐈𝐧𝐭𝐞𝐫𝐧𝐞𝐭 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧

The adoption and spread of #BTC are growing along a similar trajectory to that of the Internet and have already reached 4.7% of the global population—the same user… pic.twitter.com/8qQxMMAWuO

— 𝐒𝐦𝐚𝐫𝐭 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 (@_SmartLiquidity) May 25, 2024

A few reminders/things to point out:

– Bitcoin doesn’t represent all cryptos, but it’s the oldest and accounts for roughly 60% of the market’s dominance.

– 2024 estimates for global crypto adoption range from 560 to 617 million people, anticipated to hit 861 million by the end of this year. At best, this is still less than 11% of the global population.

– We now have a much larger global population and much more established technology infrastructure than in 1999, which should lead to even faster and greater BTC/crypto growth.

– Global (nominal^) GDP has more than tripled since then—$35 trillion in 1999 vs. $105 trillion in 2023, and more than doubled per capita. Thus, there’s more liquidity to boost crypto prices than (Internet-related) tech stocks at the turn of the millennium.

^ I admit that real GDP—accounting for inflation—is a more accurate reflection of the global economy’s value. Still, I could not find a GDP deflator (figure) for the entire world to compare 1999 vs. 2023 stats accurately.

Don’t second guess your exit strategy

Many have the temptation to get excessively greedy and hold off from profit-taking.

If you insist on holding for years and not cashing out a cent, all power to you.

However, I imagine most of us want to cash out at least some crypto profits to reinvest in other asset classes, particularly real estate, including one’s first/main home.

You don’t have an exit plan? No worries, here’s a concise guide to help you.

Once you take profits, be at peace with your decision and move on. Dwelling over the past or what could have been doesn’t help. Instead, look ahead for the next opportunities.

Underestimated potential

The advent of smart contracts on Ethereum, which was launched in 2016, has opened up unforeseen possibilities in crypto.

Decentralised Finance (DeFi) is one of the biggest and most established aspects of crypto/blockchain technology to benefit from smart contracts, notably with automated market makers (AMMs) through liquidity pools.

This has opened up opportunities for blockchain-based P2P lending and borrowing, with Aave being one of the most successful protocols in this realm.

However, slow and expensive fees on Ethereum’s base layer and a lack of account and chain abstraction so far (which would lead to a far better UX and UI) across all chains still puts us from an ideal scenario in crypto, but we are slowly getting there.

The growth of (mostly centralised) L2s and Solana’s emergence as a major competitor to Ethereum—offering cheaper and faster transactions, albeit less decentralised—give us a glimpse into what’s in store.

Many naysayers dismiss crypto as all style and no substance, but this is partially because they don’t see where this will be within 12- 15 years.

DeFi scratches the surface. Let’s not forget about the:

– massive popularity of NFTs

– promise of tokenising real-world assets (RWAs)

– Enthusiasm behind decentralised physical infrastructure networks (DePIN), including projects such as Render, Helium, Hivemapper, The Graph, etc.

Sidenote: You can check out the digital assets across hundreds of categories using this CoinGecko filter or one from a similar price-tracking website.

– eventual adoption of AI agents in crypto. There was an intense narrative until three months ago, when assets such as $VIRTUALS, $AI16Z, $VVAIFU, and $GOAT went parabolic. Fortunately, this mania died down, but expect it to pick up again in due course.

Considering that less than 10% of the global population is still involved in crypto and that these sectors are still in their early days, you’ll begin to understand the opportunities ahead.

————————————————————————————————————————–

Even though many investors are banking on 10, 20, 50, or even 100x gains from small—to mid-cap cryptos, don’t be put off by these large caps and BTC (a mega-cap).

If there’s genuine potential with adoption and their respective blockchains remain secure, they’ll remain worthy buys.

Are people discouraged from buying the Magnificent Seven or other Big Tech stocks because of their enormous market caps? No, these remain popular investments and have generated reliable ROIs.

Even Tesla – despite EV competition and politics involving Elon Musk – has risen by 585% over the past five years.

Additional thoughts

Between delusional mainstream media coverage, institutional investors wanting to control this market, blissfully ignorant or jealous people, you will still feel like the odd one out by choosing to invest in crypto.

For perspective, less than 15% of people in most countries own crypto (including BTC for the maximalists).

Even for the 28% of American adults who reportedly own crypto, expect plenty of backlash from the detractors for years to come.

When you factor in the statistics I’ve covered throughout the piece, you’ll understand that the good days for this space are far from over, albeit not as profitable for BTC, ETH and other large-cap altcoins.

To achieve financial freedom from crypto, you’ll need to be more strategic and patient about investing in it, while ensuring adequate exposure to BTC and ETH.

To help you time the market as best as possible, the Crypto Fear and Greed Index and search data from Google Trends can help you with this timing.

Remember that the true CFGI figure might be delayed by 24-36 hours, so it is not always the most accurate information. Nevertheless, it is a useful metric.

However, I would refrain from focusing on the buy-the-dip strategy. Instead, you should use it in conjunction with dollar-cost averaging. I recently published an article covering the DCA profitability of BTC vs. ETH.

As crypto and tech is highly dynamic, expect to tweak your portfolio accordingly, making fact-based decisions instead of relying on emotions.

As boring as they may seem, keeping a close eye on key news, partnerships, political and business developments in this sector will help you make wiser choices amid all the noise and influencers sending you down the wrong path.

————————————————————————————————————————–

Many laypeople mock the technology for lacking real-world utility, dismissing it as useless.

Here’s a blast from the past, back in the day when the 3.5-inch floppy discs still reigned supreme:

“So how come my local mall does more business in an afternoon than the entire Internet handles in a month? Even if there were a trustworthy way to send money over the Internet—which there isn’t—the network is missing a most essential ingredient of capitalism: salespeople.”

Clifford Stoll, February 1995, Why the Web Won’t Be Nirvana

This aged better than the world’s best fine wines.

This quote was an excerpt from one of many atrocious predictions about the Internet.

Who’s to say this won’t be true for Bitcoin, altcoins, and distributed ledger technology?

To put it bluntly, in most cases, most (if not all) forms of technology in their early days are terrible.

Crypto is in the same boat at the moment and we recognise this.

Bitcoin is slow and has limited smart contract functionality.

Ethereum still supports many smart contracts, a major component of decentralised applications. However, its base layer remains ridiculously slow and fees are still above average, albeit much better than a few years ago (courtesy of L2s).

Other L1s – BNB Chain, XRP Ledger, Solana, Cardano, etc. have promise but are still far from mainstream usage…and that’s OK, at least for now.

Good things take time.

Let’s not forget how far the space has come since the 2017 bull run.

If you cannot wait and find this boring, flock to meme coins or something more “stimulating.” But I wouldn’t recommend doing this, as you’ll likely get burned in the long run.

————————————————————————————————————————

For most of Bitcoin’s history, the US Fed Funds Interest Rate has been below 2%.

Yet, Bitcoin has hit $100,000 with interest rates at 4.5% p.a.

Once interest rates significantly fall again, expect The Fed to restart the money printer.

And you know that means for this market? Even more liquidity.

You will still make ridiculous gains in crypto, but it will take longer than expected, possibly more than one cycle.

As frustrating as it is, it will ultimately feel more satisfying, demonstrating a true test of patience, especially for BTC and large-cap altcoins.

This contradicts the (still) popular belief that crypto is a get-rich-quick scheme. Some digital assets still fall into this category, but this is no longer true for the blue chips in this space.

How long do you believe it will take for crypto to hit a $10 trillion circulating market cap? Leave your thoughts below.

Affiliate link

If you want to purchase a Trezor product, use the following link to help support my channel. I receive a small commission per sale at no additional cost.

https://affil.trezor.io/aff_c?offer_id=133&aff_id=35611

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. This information is for educational purposes only. You are ultimately responsible for your investments.

- My opinions in this piece might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your own research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

- BTC and ETH account for approximately half of my crypto portfolio. ADA and XRP represent another 25%.

Featured image by Hodoimg at Shutterstock.