Crypto holders just couldn’t help themselves, with many getting spooked left, right and centre.

First, DeepSeek released its latest AI model, the R1, which caused a sharp decline among tech stocks and crypto assets.

Argentinian President Javier Milei becomes embroiled in the Libra pump-and-dump controversy.

Then comes Trump’s announcement regarding tariffs on Canada, China and Mexico.

Let’s not forget about geopolitical tensions worldwide, the ongoing rumblings of a looming stock market crash, and the major slowdown of the U.S. economy, i.e., the recession.

It looks like we’ve invited the bears to our post-election crypto party.

Before you start panicking, ask yourselves these questions:

– Has anything fundamentally gone wrong with a particular blockchain/network, i.e. Has it been hacked?

– Have (almost) all governments worldwide carried out some form of coordinated, simultaneous attack in this asset class and industry?

– Is the entire world at war?

No, no and depending on whom you ask, possibly, but not the conventional type of conflict.

Considering how things have panned out in recent years, the last point wouldn’t surprise me.

Thus, keep calm and carry on by accumulating when the prices tank.

Think of this as a massive storewide sale that will inevitably occur again, as it has several times over the years.

It’s ironic that people ignore the best time to buy crypto, when there’s the lowest risk involved. Yet, there’s a frenzy when the market’s close to peaking.

What a bizarre world we live in.

Is this the end of the bull market?

Not yet, but we’re closer to its end than its start.

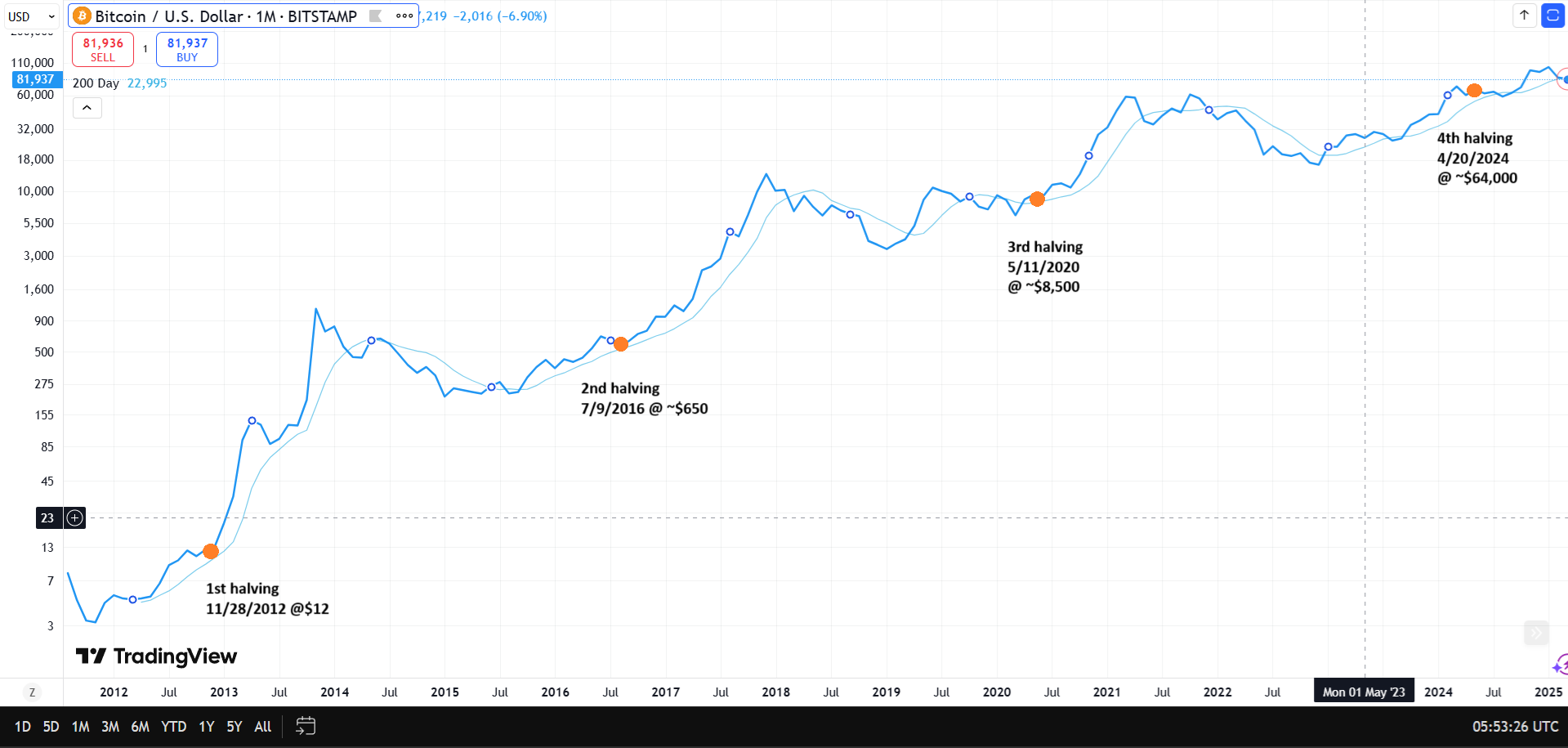

I am mostly basing this off the first three post-Bitcoin-halving bull cycles, as shown below.

BTC/USD historical price chart with SMA (thin line) and Bitcoin block reward halving dates.

Source: TradingView. Orange dots and dates added by the author.

However, there are major differences between this bull market and past ones.

Bitcoin hit a local peak of around $73,000 in March 2024, marking a new all-time high following the $69,400 ATH in November 2021.

This game is about earlier than expected as Bitcoin typically peaks after the halving, whereas this time it occurred beforehand.

If this were the case, could Trump’s inauguration signal the beginning of the end of this bull run?

I doubt this is the case, but at least so far, this argument has been holding up. It’s only been two months, so let’s not get ahead of ourselves.

Crypto analysts such as RektCapital and @TheFlowHorse believe this cycle could peak sooner than expected. The former also acknowledged that this period might last longer than previous bull runs.

Pantera CEO Dan Moorhead believes BTC will peak this August at $117K.

Ultimately, these are all (well-educated) predictions and no one knows for sure.

In the coming days, many will closely observe Bitcoin’s price relative to a popular technical-analysis indicator: the simple moving average (SMA), which represents the average closing price over the past 200 days.

Source: TradingView

As a rule of thumb, it is bullish when the price is above the SMA, and bearish when it is below it. It’s often used to determine medium- to long-term trends for various securities and commodities.

However, this is only one of several metrics to confirm whether a trend is continuing or about to change. Other examples include the relative strength index (RSI), resistance levels, the U.S. Dollar Index, a.k.a., the DXY (Thinking Crypto regularly analyses this), a 50-day moving average and its relationship to the SMA, i.e., Golden Cross and Death Cross.

Additional thoughts

Is this the end of the crypto in general?

Keep on dreaming. Many people wholeheartedly want this to happen so they can finally feel vindicated whenever they say, “Bitcoin is dead, it’s a bubble, crypto is a scam.”

To reduce the risk of panic selling, do not invest more than you are willing (and able to afford) to lose.

As cliché, annoying and cringeworthy this sounds, it’s usually the best option.

Remember when the world felt like it was ending in 2020 and crypto prices completely collapsed?

A picture is worth a thousand words, so I’ll let this image do the talking.

BTC/USD historical price, CoinGecko data, snapshot, 11 Mar 2025, 04:20 UTC.

To reiterate, when in doubt, ZOOM OUT.

Besides crypto prices, another figure to watch is the Bitcoin/Crypto Fear and Greed Index.

It’s currently less than 20, indicating extreme fear. Yet, BTC’s price is still higher (at $80K) than when the index hit extreme greed in December 2023 ($44K BTC) and throughout March 2024 (~$71K BTC).

In other words, Bitcoin has continuously set higher highs and lows. This becomes even more evident when analysing bull and bear cycles as displayed on a log10 BTC/USD chart.

I can’t show the CFGI chart (with the BTC/USD price overlayed) or name the source because I’d otherwise have issues publishing this article on Medium, but it’s data from a popular crypto price-tracking website.

Anything with a long-term mindset knows that some projects will become behemoths in the coming years, making it a matter of when, not if.

Whether or not this involves Bitcoin (at a $1.6 trillion market cap) remains to be seen, but I am quietly optimistic that it will continue closing on gold’s market cap. At $19.5 trillion, gold is the most valuable asset in the world and has had an impressive 12 months, so BTC will have its work cut out for it to become numero uno.

Affiliate link

If you’d like to purchase a Trezor product, you can use the following link to help support my channel. I receive a small commission per sale at no additional cost to you.

Further reading

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- My opinions in this piece might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

- Ethereum (ETH), Bitcoin (BTC) and Cardano (ADA) collectively account for about 65% of my crypto portfolio in order of holdings.

Featured image by Wit Olszewski at Shutterstock.