15–20x opportunities for the rest of this bull market.

While Bitcoin (BTC), Ethereum (ETH), XRP and Solana (SOL) dominate the crypto market cap and much of the news, several altcoins are rapidly gaining traction and working their way up the ranks.

Besides a handful of meme coins that have made ridiculous gains over the past two years, various assets with actual utility have punched well above their weight.

Some of these have been around for a few years, but we’re still early, and these industries have yet to discover their full potential.

Here are the five crypto and blockchain-tech sectors to watch if you want to see a solid ROI.

These are listed in descending order, so I’ve saved the best until last.

5) NFTs

Hasn’t all the mania surrounding these tokens died already?

You might be thinking of the metaverse, which is barely discussed nowadays compared to its heyday in 2020 and 2021.

NFTs are a different kettle of fish.

Various digital art collectibles have been sold for astronomical sums. For example, a CryptoPunk NFT was purchased for 8,000 ETH ($23.7 million) in February 2022, and the most famous example is Everydays: The First 5000 Days for $69.3 million, produced by Mike Winkelmann (a.k.a. Beeple).

It is nonsensical to spend an enormous amount of money on a CryptoPunk NFT; perhaps I’m missing something that could justify forking out (tens of) millions of dollars.

I’d make an exception to Beeple’s record-breaking collectible, as unlike the former, it’s a montage of 5000 pieces of artwork involving vast creativity. Even then, I’d prefer dozens of prestigious homes, but I digress.

So why do I believe they’ll experience a renaissance this cycle? A major advantage of this bull market is the availability of various alternatives to Ethereum for minting and trading NFTs.

The rising popularity of Solana and the advent of L2s since the 2020–21 cycle means it’s unlikely we’ll see gas fees above $60, at least not for lengthy periods.

We’ll still witness these ridiculous gas fees sometimes, but this phenomenon will eventually become non-existent once we see massive scalability improvement on Ethereum’s base chain.

Despite being far from their peak popularity during the last bull cycle, popular NFT protocols such as OpenSea and Blur have experienced significant increases in trading volumes and active users. They are already up by >3x so far in December versus November.

NFTs remain relevant as they offer the benefit of scarcity and a digital form of provenance. With blockchain technology, you can confirm the original creator and ownership history since a product’s launch.

These also streamline the process for artists to have more control over royalties, including stipulating rules to earn a percentage in perpetuity without relying on intermediaries.

Much of this space will involve scams and numerous superficial displays of flaunting one’s wealth by forking millions on mediocre, overpriced creations. On the other hand, many NFTs with artistic flair, uniqueness and rarity will benefit from this novel system on top of a blockchain.

4) DeFi

While this was a major narrative in the lead-up to and during the last bull cycle, this sector is still far from its peak.

In particular, the projects to watch are automated market makers, decentralised lending protocols, re-staking services and asset tokenisation (more on this one shortly).

While Aave (AAVE) remains one of the oldest and largest DeFi protocols and will remain a profitable choice for the foreseeable future, I’m more excited about Ethena.

This platform offers synthetic assets, particularly synthetic dollars, which are considered a better alternative to stablecoins. Before continuing, what on Earth is a synthetic dollar?

“We define synthetic money as a currency basket whose composite value closely mimics the value of a single currency but does not contain this currency.”

Hovanov, Kolari & Sokolov 2007

Ethena offers its synthetic dollar (USDe), which boasts the benefits of high transparency, censorship resistance, scalability, stability, decentralisation, and unit economics. Check out these resources to learn more about USDe.

Two weeks ago, it announced its launch of USDtb, with its reserves invested in BUIDL. According to the related blog post, this other stablecoin functions independently of the above synthetic dollar, which “carries a completely differentiated risk profile compared to USDe.”

With its lower market cap and synthetic dollar — touted as a more versatile alternative to collateralised stablecoins, namely Tether (USDT) and Circle’s USD Coin (USDC) — Ethena USDe (USDE) is emerging as a viable alternative to the USDT-USDC duopoly.

Other DeFi protocols and tokens to consider buying are:

— Lido Finance (LDO) is ETH’s leading liquid staking provider. It has recently expanded into re-staking services, giving you extra opportunities to boost your APY when staking ETH.

— Pendle (PENDLE) has become a leading player in the re-staking space.

I frequently mention this concept, and it will likely become increasingly popular, provided that it remains secure and generates consistent rewards.

https://medium.com/@cryptowithlorenzo/subscribe

3) Real-world assets (RWAs)

RWAs and the remaining two categories will lead to some of the most profitable companies and digital assets, with multi-trillion-dollar industries ripe for tech disruption.

When BlackRock is keenly interested in RWAs, you know it’s time to pay attention.

Earlier this year, the renowned asset manager launched its BlackRock USD Institutional Digital Liquidity (“BUIDL”) Fund via Securitize, a fintech that specialises in tokenising RWAs.

It manages over $1 billion of tokenised assets on-chain (as of October 4, 2024).

Notable projects associated with this sector include:

— Ondo ($ONDO): Ondo (a.k.a. Ondo Finance) aims to make institutional-grade products and services universally available through the power of blockchain tech.

One of its key products is Flux, which allows people to loan and borrow stablecoins against short-term tokenised US Treasuries. The only collateral available on this platform is OUSG, a tokenised Treasury issued by Ondo Finance.

— Propy ($PRO): This platform helps connect property buyers and sellers and settle contracts faster, cheaper, and more effectively using AI and blockchain technology. Best of all, smart contracts allow you to close these deals 24/7.

Furthermore, notable advisors, including Michael Arrington (TechCrunch), Daniel Kottke (Apple), Barry Enderwick (Netflix), and Tim Draper (a venture capitalist who is extremely bullish on Bitcoin) are helping shape the project.

As Bitcoin, Ethereum, and altcoins/tokens have created a system where you can easily own the tiniest fraction of crypto, there will be a system where you can easily trade fractions of stocks instead of buying whole amounts.

We’re in the early days of this with tokenisation. Still, this concept will become mainstream as Ethereum and other smart contracts platforms become more established (and once the former processes more transactions on its base chain while remaining secure and decentralised).

— Dimitra ($DMTR): This protocol is headed by the AgTech firm Dimitra Incorporated. It offers products to help smallholder farmers harness the benefits of blockchain tech for improved yields, better mapping, and less wastage, i.e., run-off of excess fertiliser, pesticides, and herbicides. This will, in turn, provide better environmental and financial outcomes.

Earlier this year, I wrote a piece focusing on this project.

— Tether Gold ($XAUT) is an ERC-20 token pegged to the price of one fine troy ounce of gold. Tether’s reserves are fully backed by physical gold under the Good Delivery standard of the London Bullion Market Association (LBMA).

Unlike purchasing gold via conventional markets, XAUT is available 24/7. Furthermore, you can have exposure to gold without worrying about storage costs and readily convert to and from digital assets, which was unavailable before gold stablecoins like XAUT hit the scene.

2) Decentralised physical infrastructure networks (DePIN)

Besides AI, DePIN has been another buzzword in this space, and for good reasons.

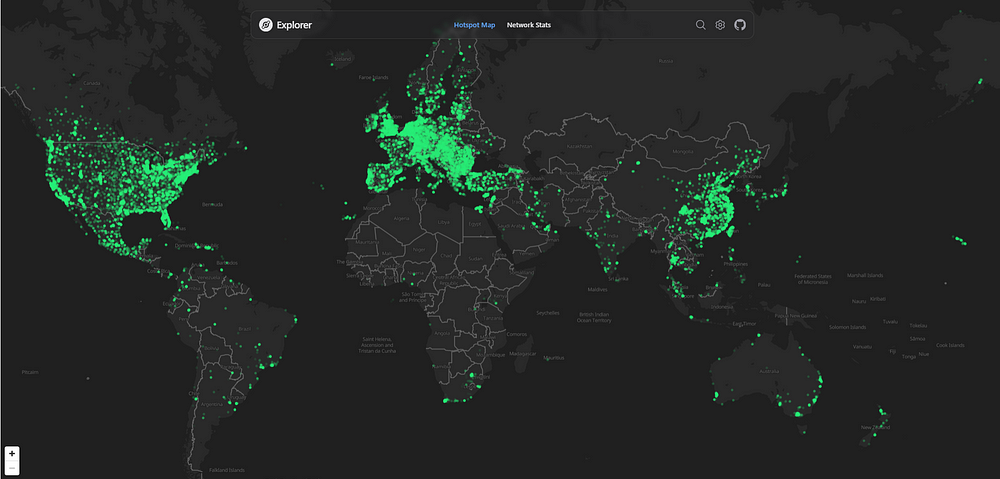

Render (RENDER) and Helium (HNT) are two large-cap DePIN networks I’ve covered over the past two years, which will likely remain dominant players in the space.

The former has already set a new all-time high this year, while the latter is beginning to bounce back after an impressive run in 2020 and 2021.

What’s special about these projects? They’re taking on established centralised entities that dominate the respective fields these protocols focus on: GPU power for rendering and a decentralised alternative to conventional telecommunications networks.

. Snapshot taken on 26 December 2024 at 06:35 AEDT.

For this cycle, keep an eye on Hivemapper (HONEY), seeking to disrupt Alphabet’s (Google’s) dominance in mapping software, among other tech sectors.

I covered this in one of my most popular pieces, identifying key altcoins to buy in 2025.

1) AI Agents

The general AI/AGI narrative over the past two years remains strong, and many related assets — Artificial Superintelligence Alliance (ASI), The Graph (GRT), Near Protocol (NEAR), and VeChain (VET) — will build on their success to date.

However, the focus here is on AI agents.

As many of you have already read the AI agents piece I published earlier this month (link below), I will refrain from saying too much here.

This software can gather data, connect to its environment, and use the information to carry out independent tasks and achieve pre-determined objectives.

Unlike bots that follow specific rules for certain outcomes (deterministic models), AI agents are much more flexible and constantly learn new information to make better decisions. They use probabilistic models (ones that account for randomness and deal with likelihood).

AI agents offer vast productivity improvements, particularly when conducting research and analysis by investors and traders. These sophisticated tools can also manage decentralised oracles, APIs, Web3 wallets, and other crypto and blockchain tech purposes.

Virtuals Protocol ($VIRTUALS) has been one of the best-performing assets in this sector, up ~6,500% over the past three months. Other projects and assets related to this AI subset include Artificial Superintelligence Alliance ($FET*), AI Agent Layer ($AIFUN), Goatseus Maximus ($GOAT), and Dasha ($VVAIFU).

*Soon to be $ASI.

Concluding thoughts

Many underestimate these crypto sectors’ benefits in terms of improved accessibility to retail investors, convenience, competitive pricing, and greater productivity, as provided by emerging technologies such as AI agents in crypto.

Before I forget, some will call BS on the idea of 15–20x for altcoins I’ve listed here, particularly by the end of 2025.

Some won’t, e.g., AAVE and others with a market cap above $4 billion. However, many could but don’t bank on it.

Much of this market is irrational, so expect the unexpected. Nonetheless, we have to be realistic with ourselves.

As a reminder, it’s important to factor in the fully diluted MC when dealing with market caps rather than focusing on what’s in circulation.

What other sectors should be listed here? Which one are you looking to in terms of massive growth in the coming years? Leave your thoughts below.

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. This content is for educational purposes only. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do sufficient research (DYOR) before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• Bitcoin (BTC) and Ethereum account for about half of my crypto holdings, followed by Cardano (ADA) and XRP, making up another 25%. The assets I’ve listed collectively represent 15% of this portfolio.

Consider how much you’re willing to allocate to these altcoins and whether you can afford to do so, as this remains a highly volatile asset class.

Originally published at https://www.cryptowithlorenzo.com

Ways to Support My Crypto Writing – Promotions and Affiliate Links