The (relative) calm before the storm.

N.B. Given the coincidence, I’ve reworded the article to the current title. This was initially titled Why Bitcoin Hasn’t Crossed $100K.

Was $400 extra too much to ask?

For many people, it was.

Now that it’s hit $100,000 expect a wave of retail investors to start pouring in, some of which have already returned.

$100,000 marks the first time BTC has reached six figures, presenting a massive psychological milestone for many current and future investors.

Why did it take longer than expected?

Two words: Institutional investors.

BlackRock, in particular, keeps on coming to mind.

The multi-trillion–dollar asset manager — spearheaded by Bitcoin proponent Larry Fink — is rapidly accumulating what many still believe is “digital gold”.

Its iShares Bitcoin Trust (IBIT) now controls

, valued at ~$50.2 billion. All the spot Bitcoin ETF providers combined hold

, accounting for 5.4% of the total circulating supply.

Moreover, the continuously dwindling BTC supplies on exchanges are further intensifying Bitcoin buying pressure. According to

, these are at their lowest since February 2018.

Back then, BTC ranged from

per coin. If only we could go back in time…

These factors, alongside the programmed halving of Bitcoin block rewards every 210,000 blocks (roughly every four years), translate to an immense supply crunch.

These factors, alongside the programmed halving of Bitcoin block rewards every 210,000 blocks (roughly every four years), translate to an immense supply crunch.

Even with steady demand, we’ll see price increases. We expect more people to buy BTC, ETH, and other valuable digital assets with built-in scarcity and robust fundamentals.

Just wait until we see these legacy asset managers and centralised exchanges gradually rolling out lending and liquid staking opportunities to clients.

This will make it even more enticing for people to hold BTC.

https://cryptowithlorenzo.medium.com/subscribe

What makes me sure that many everyday investors haven’t rushed back into the market?

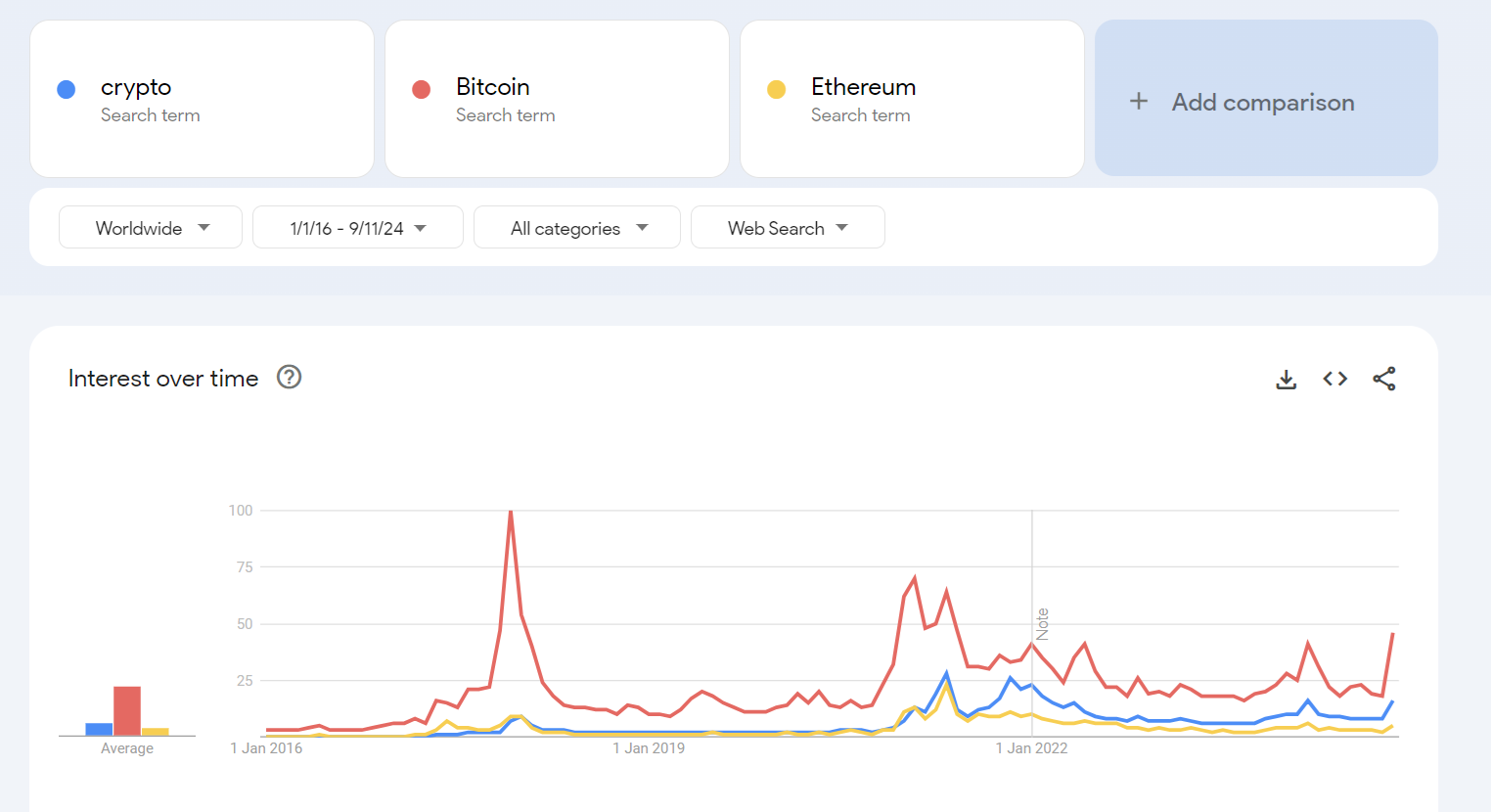

Google Trends data.

This is a screenshot I took earlier today with relevant data from 2016.

Data source: Google Trends. Click on the image (or here) to access the chart with the abovementioned variables. The date range is in DD/MM/YY format.

Notice how interest in BTC and ETH search terms remains less than half their historical peaks.

Many people who bought BTC towards its 2017 ATH could no longer tolerate the massive drop and ultimately opted to sell at an enormous loss. As a result, they most likely left the market for good.

However, I expect some of these individuals to re-enter the space and give it another shot, especially since the advent of spot Bitcoin ETFs and its growing institutional interest.

Sidenote: I keep mentioning institutions as many laypeople follow their lead in deciding how to invest.

Additional thoughts

BTC should reach digits within the coming days. It should have already done so, as there’s no fundamental reason stopping it; retail investors alone could have already done the job, but that’s wishful thinking.

Yes, I imagine other reasons are at play, but it’s naïve to ignore the increasing clout a handful of asset managers and multinational companies have over BTC.

Rapid and significant capital rotation will usually occur between BTC, ETH, and altcoins, as expected during bull markets. We’ve started witnessing this over the past couple of weeks.

However, the general trend remains: most digital assets have drastically increased in value over the past 30 days, with many altcoins making up for significant losses between January and October.

BTC currently sits at $98,400. One green candle, and the job’s done.

Even if it’s for a fleeting moment, people will lose their s$#t when they see six digits next to BTC, once again proving the naysayers wrong.

If you’re holding BTC and no longer like it, be grateful that it’s allowed you to boost your altcoin holdings, many of which still haven’t hit their 2021 (or 2017) ATHs. If you don’t believe me, see how your favourite altcoin compares to Bitcoin.

Anyway, enjoy the calm before the storm. Don’t say I didn’t warn you.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do sufficient research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

- Bitcoin (BTC) accounts for about 25% of my crypto portfolio.

Image by pakie3d at Freepik