People’s mounting regrets for sitting on the sidelines for years.

Trump’s election triumph and The Fed’s latest decision to cut interest rates by 25 basis points (0.25%) have recently provided much-anticipated momentum for Bitcoin and altcoins prices, sending the flagship crypto to new all-time highs.

As it approaches $100K, many will lament the years of missed opportunities to buy these digital assets.

My response? Tough luck, to put it politely.

Most people globally — I’m mostly thinking of developed countries, but to a lesser extent many wealthier individuals across the developing world — have had a solid seven years of regular media attention to this asset class, albeit negative stories for the most part.

For those who’ve been here since 2017, you’d be well aware of the rollercoaster ride we’ve had.

The 2018 to early 2020 bear market (including the brutal market crash in March 2020) and the 2021 bull run, followed by another drawn-out market-wide downturn until 12 months ago, illustrate the years of opportunities billions of people have had to get skin in the game.

With over 92% of circulating Bitcoin addresses holding at least one Bitcoin, access to the eighth-largest global asset is becoming increasingly out of reach for billions of people; these are the ones who would benefit the most from Bitcoin and altcoins.

Once BTC exceeds $100K, expect more visits to Bitcoin and crypto ATMs in your area.

Sidenote: I rarely see people using these ATMs in my local shopping centres. Are these popular in your neck of the woods? Perhaps after-hours when no one’s around…

When BTC hits $110K, it will have overtaken Amazon (at its current market cap).

Alphabet (Google), Microsoft, Apple, Nvidia and the largest asset in the world, gold, will be in Bitcoin’s sights.

Moving along. Every so often, I chat with other crypto content creators, and the same issue keeps appearing.

Despite our best efforts to educate people about Bitcoin and blue-chip altcoins (ETH, ADA, XRP, SOL…insert crypto here) and encourage our family, friends and acquaintances to add these to their portfolio, it usually falls on deaf ears.

However, when the euphoria returns to the market — which appears to be upon us again as I speak — inboxes start filling up with questions about Bitcoin.

“Hey, are you still into that Bitcoin thing? How’s it going for you?”

Call me harsh, arrogant, or whatever floats your boat, but this is akin to a random message from an ex.

To paraphrase a modern dating adage: If you can’t handle Bitcoin/crypto at its worst, you don’t deserve it at its best.

This is mostly a middle finger to the people who have ridiculed and instantly dismissed me and others in our community every time we bring up this asset class, often accompanied by the suggestion to invest in “something real and worthwhile” and “this is a bubble.”

I got over receiving messages from fair-weather “friends” contacting me out of the blue specifically about these, and I ignored them or told them I was no longer involved in this space.

Having said this, there is a major exception to the rule. If someone contacts me about a bogus crypto — or one that is most likely a scam — I will encourage them to research it further and do their due diligence before buying it. The same goes for anyone joining some obscure crypto exchange.

After many years of active involvement in this asset class, we’re usually better than the average person at sniffing out the BS in the crypto and blockchain tech scene.

I had a family friend in a similar situation, and I’ll cover that story in a separate piece.

With more fiat on-ramps, a vastly improved UX/UI since Bitcoin’s early days; more regulatory clarity and scrutiny; cheaper deposit, withdrawal and trading fees, and a growing number of reputable custodial and non-custodial wallets, I struggle to understand why people are so scared to allocate even $100 per year to BTC or altcoins.

I have close friends and family members that fall into this category. Part of me feels incredibly pissed off that they’ve squandered so many chances since I first mentioned crypto to them in 2017, and have talked about it several times since then.

On a lighter note, there’s one who insists that investing in highly speculative assets “goes against their star sign.”

You can’t make this up.

You can lead a horse to water but you can’t make it drink — moreover, each to their own.

What’s even more astonishing is the relative lack of interest from people in recent times.

Renowned crypto commentator, Benjamin Cowen, posted about this phenomenon a few days ago. He’s noticed a 75% reduction in overall channel views versus 2021 when BTC peaked at roughly $69K.

#BTC is at $76k and still no one cares.

Youtube views to these crypto youtube channels still running at 1/4th of what they were averaging in 2021 pic.twitter.com/Zbq8cNx0qr

— Benjamin Cowen (@intocryptoverse) November 8, 2024

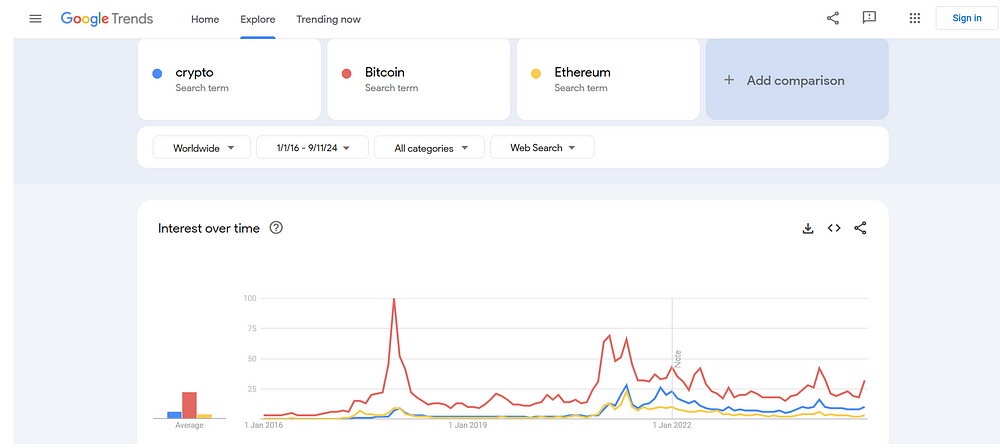

This appears to be a common theme, at least for those specifically looking for Bitcoin content. Google Trends data for searches of Bitcoin, crypto and Ethereum is also down by more than 60% for each term, relative to their peaks* in May 2021.

* For context, I set this search to ‘Worldwide’ and used Google search data from the past five years.

When zooming out and setting the date range between 1 Jan 2016 and Saturday, 9 November 2024, search results for Bitcoin peaked at the top of the bull run in December 2017, as shown below.

https://www.google.com/trends)

.” Click on the image (or

) to access the chart with the abovementioned variables.

Additional thoughts

For anyone who says you’re “lucky” for making a significant windfall with Bitcoin, altcoins or associated crypto stocks, it boils down to these points:

— Fortune favours the brave.

— Patience is a virtue.

Elon Musk, Jeff Bezos and other billionaires made their vast fortunes because they had a pair of cojones to take risks, have firm convictions and persevere through the downtimes.

Yes, they received assistance along the way, some more than others.

Back to Bitcoin and crypto. If you’ve made it or managed to profit from this industry within the next 9–12 months, you did it because you’ve taken calculated risks, accumulated during the harsh, prolonged bear market(s) and adopted a minority mindset to learn about this revolution asset class and (fin)tech sector.

So the next time someone tells you you’re lucky to be in crypto, laugh and tell them, “No risk, no reward.”

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your own research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• Bitcoin (BTC) and Ethereum (ETH) account for about 50% of my crypto portfolio at the time of writing.

Featured image by wedding_and_lifestyle_photo at Freepik