Crypto assets and their respective projects have come a long way since Bitcoin’s debut in 2009.

The vast swathe of dApps that have burst onto the scene since the advent of smart contracts, dozens of reputable exchanges (and DEXes), a growing range of non-custodial wallets, NFTs, layer-2 scaling solutions that provide a much better UX/UI experience for the end user, and more companies embracing the technology are impressive achievements for this nascent asset class.

Despite the progress, certain aspects of crypto have barely changed since the early days, or, in a few cases, things have gone backwards.

Bitcoin and Ethereum are still slow

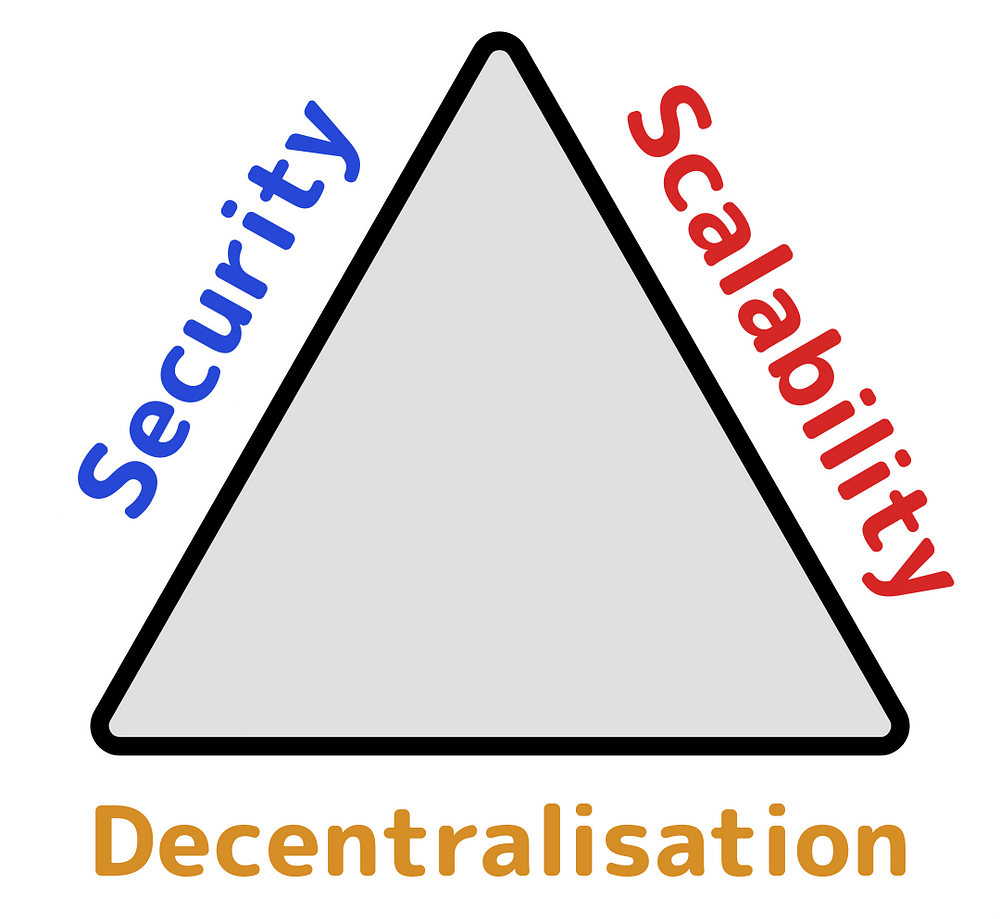

Anyone who suggests measures to significantly boost throughput (transactions per second/TPS) is quickly reminded of the Scalability Trilemma, also known as the Blockchain Trilemma.

First described by Vitalik Buterin in a 2017 post, this represents a trade-off between security, scalability, and decentralisation. To date, only two of these have been possible simultaneously.

It’s the same with tasks. It’s very rare to find someone who can do a job very well, quickly, and cheaply.

When people note that these chains are considerably slower than Visa or Mastercard, remember that these legacy payment networks use centralised systems to achieve robust security and consistently high throughput.

The point of Bitcoin, Ethereum, and other decentralised blockchains is to move away from the current setup of depending on companies to process transactions and instead opt for a censorship-resistant peer-to-peer system that bypasses a third party.

While Ethereum has progressed with L2s (as discussed above), systems such as The Lightning Network and The Liquid Network are far from becoming mainstream.

At least one of these will eventually make it and help Bitcoin process many more TPS but don’t bank on this happening anytime soon.

Does this mean Bitcoin is useless? Absolutely not.

This remains the strongest and most decentralised blockchain, with an uptime of 99.98% and a perfect track record since 2014.

These distributed networks will eventually overcome this Trilemma. As security and decentralisation take precedence over scalability for the flagship crypto asset and blockchain — not to mention Bitcoin’s block generation time of ±10 minutes — it will take a while before Lightning or Liquid networks become mainstream.

The good news is that Lightning Network adoption is increasing, with more crypto exchanges implementing this scaling solution — including major ones such as Binance, Coinbase, Kraken, Kucoin, and OKEx — to ease network congestion on Bitcoin.

You can learn more about the Lightning Network by checking out its whitepaper and this piece published by Investopedia last month. It discusses three possible problems with it and suggests solutions.

https://medium.com/crypto-insights-au/12-signs-that-you-are-ahead-in-the-crypto-game-12a29aa03979

Memecoins have exploded in popularity

Long gone are the days when Dogecoin was the (main) talk of the town for the joke coins.

In the last bull run in 2021, there were 92 liquid memecoins, i.e., with a trading volume greater than zero.

Since then, the number has skyrocketed to over 1,000 liquid memecoins as of March 2024.

Moreover, roughly 89% of these projects have a reported market cap of up to $1,000.

Yes, one thousand bucks, not one million.

What has allowed this to happen?

A major reason is the growth of L1s, notably Solana. According to the crypto price-tracking website CoinGecko, over 650 memecoins exist on Solana, representing a total Solana Meme market cap of $11.7 billion.

There has also been a rapid expansion of Ethereum L2s, particularly since the implementation of Proto-Danksharding.

When Ethereum was the only viable and trustworthy* L1 around, transaction fees became astronomical, especially when swapping from an ERC-20 token to another using a decentralised exchange. That was the period (around mid-to-late 2021) when gas fees for conducting such swaps exceeded $100 per transaction, sometimes hitting $400.

Expecting memecoins to die off anytime soon? Think again.

With diminishing returns for BTC, ETH, and other blue-chip crypto assets, many people — especially newbies — hope to find the next 100x or 200x gem for life-changing gains.

When AI memecoins are pumping but you’re all in on $ETH pic.twitter.com/Py9vny7d7w

— Lark Davis (@TheCryptoLark) October 24, 2024

DOGE and SHIB have had their time in the spotlight; PEPE and BONK have already pumped, which means attention (and money) quickly shifts to the “next big thing”.

Good luck if you want them to F off and vanish into the ether anytime soon.

As nonsensical as they are, memecoins remain popular and offer entertainment value (albeit lowbrow) for certain people.

Heck, I’ve decided to throw $50 to $100 into a couple of these just for shits and giggles. Ivan on Tech has taught us to see the funny side of it, which is needed during increasingly bizarre times.

The dog-themed tokens have moved to the back burner, and their cat-themed counterparts are taking over the space, alongside celebrity-themed and “sentient” memecoins.

*Some Ethereum maximalists will argue it remains the ONLY reputable smart contracts platform, but you can be the judge of that.

I recommend reading BDC Consulting’s Memecoins 2024: Market, Trends and Opportunities report for an extensive overview.

Scams remain rife

While fraudulent activity in this asset class accounts for a tiny percentage of overall trading volume and market cap, these still tarnish its overall reputation.

Even though institutional investors have been pouring into the space in recent years — the advent of spot Bitcoin ETFs in the USA being a major milestone — distrust remains.

Then again, this all ties into risk and reward. We’ve had speculative assets for centuries, dating back to the Tulip Mania in the 1600s.

When considering more conventional investments, penny stocks and similar small-caps would be the closest thing to the crypto assets many love (and others loathe).

Furthermore, scams come in different shapes and sizes and have existed for centuries (snake oil, anyone?) and even millennia. Many bogus products in our society ruin the reputation of the legitimate ones that do work — remedies, investments or otherwise.

The same applies to crypto. The unregulated nature of this space and asset class means that anyone with enough knowledge (which, courtesy of extensive info online, is pretty much anybody) can create a new token on an established chain within minutes.

There will always be naïve people who fall for these bogus projects, thinking they’re a part of a new “community” to get the latest fad to moon and generate life-changing rewards.

Yes, some people generate 200, 300 or even 500x ROI, but only a small percentage of those who got rug-pulled would be willing to share this.

Never believe anyone who says you’ll have guaranteed returns in this space is lying. Nothing is certain in crypto. Remember that.

The rapid growth of AI and more advanced models will only make scammers more sophisticated. Uncertain economic times and desperation could make vulnerable people more inclined to fall prey to convincing, albeit fake, messages to transfer money to an “exchange wallet,” only never to see their funds again or to fall victim to a pump-and-dump.

An oversaturated space

How many L1s, L2, DEXes, stablecoins, memecoins, automated market markers (AMMs), and DePIN projects do we need?

I understand there will be a handful of highly successful crypto companies like those that thrived following the Dot Com boom. Considering the number of categories within this broad sector, this will amount to at least 100 mid-sized to large enterprises in future.

Nonetheless, the current number of competing projects in the space is overkill — over 2.5 million and most likely counting…until we get a massive and long overdue shakeout of the scams and unnecessary projects.

Whether Bitcoin and Ethereum will remain relevant in 20–30 years remains to be seen. I imagine they will, but don’t rest on your laurels.

I anticipate greater collaboration between projects and the formation of various alliances in the coming years, as only a limited number of crypto companies and blockchains will survive.

A prominent example in recent months is the creation of the Artificial Superintelligent Alliance, whereby Fetch.AI, SingularityNET and Ocean Protocol opted to merge their three separate tokens into one, FET (which will convert to ASI in early 2025).

While they remain three separate projects, they will share resources and expertise to “foster innovation, transparency, and inclusivity in the development of advanced AI technologies.”

Check out the ASI website to learn more about this partnership.

It is far from mainstream usage

Smart contracts that can automatically deploy once pre-established conditions have been met without needing an intermediary have led to tokenised real estate, art and other highly valuable tangible goods.

We have blockchain companies such as Dimitra that aim to revolutionise forestry and agriculture.

Ripple is still collaborating with companies to offer secure and cheap international money transfers processed in seconds at a fraction of the cost of traditional remittance options.

Despite the excitement surrounding the wide range of current and potential use cases of distributed ledger technology, we haven’t made it…yet.

It will take off when various L1s achieve over 10,000 TPS (an arbitrary figure) while maintaining high security, sufficient decentralisation, and low fees.

Once billions of people and several institutions are convinced that this new system operates like a routinely well-oiled machine, we’ll have the mass adoption many of us have dreamed of for years.

Additional thoughts

I am not singling out Bitcoin and Ethereum for their shortcomings. Other networks, such as Solana, BNB Chain, XRP Ledger and Cosmos, have opted for less decentralisation (i.e., far fewer nodes) than the two biggest blockchains. This allows them to handle more TPS and generally offer cheaper transaction fees while maintaining adequate network security.

I know some people will be angry that I haven’t referred to the energy-intensive nature of Bitcoin mining, whereby its network is continuing to set new all-time highs for its hash rate, now at 737 Exahashes per second.

A few things many laypeople (and even some of those well-versed in Bitcoin and crypto) are:

— The energy demands for mining equipment aren’t necessarily the issue. The main considerations here are the energy sources used, i.e., what percentage of BTC mining is derived from renewable energy or nuclear, and how e-waste from discarded miners is managed. I have spoken extensively about these topics.

— Bitcoin mining provides the additional benefit of readily utilising periods of excessive renewable energy that would have otherwise been wasted. Well-planned operations can exploit this surplus without burdening a town or city’s energy supplies. However, I admit there are many instances where this isn’t the case.

— Network security relates to Bitcoin’s hash rate. While it isn’t the only metric that determines how robust Bitcoin’s blockchain is, it is an important indicator (two others being the number of reachable nodes and their geographic distribution). The greater the hash rate for any Proof-of-Work network, the harder it becomes to carry out a 51% attack.

In conclusion, many of us are here for the long haul. Good things take time, and when over $2.28 trillion is at stake ($1.33T in Bitcoin alone) and growing, we shouldn’t rush things.

The Internet was atrocious in its early days compared to now, let alone any early iterations of the tech we use daily.

Sooner or later, the Bitcoin/crypto haters will give up and return to their echo chamber, albeit to no avail. I hope they enjoy their efforts in trying to take down this space when they simply could have hopped on the bandwagon years ago. Alas.

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your own research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• Bitcoin (BTC) and Ethereum (ETH) account for about 50% of my crypto portfolio at the time of writing.

Your ability to distill complex concepts into digestible nuggets of wisdom is truly remarkable. I always come away from your blog feeling enlightened and inspired. Keep up the phenomenal work!