Not this cycle, but most likely during the next one, which will come sooner than expected.

This represents how much ETH’s price has risen since launching in 2015.

Today, I will cover three catalysts that, in addition to the positive sentiment returning to the space, will further propel ETH’s price in the coming months and years.

Before you get ahead of yourself, I doubt we’ll see this by the end of the (current) bull market. Rather, I believe it will eventually hit $50K. If I had to give an approximate timeframe, I would say by 2030-31.

TL;DR

– $7K in 2024, ~$13K at the cycle peak, IMO.

– $40K by the end of this decade.

– I’ll be keen to see how Solana co-exists with Ethereum moving forward and if it manages to reduce its dominance. This (and other L1s) would make me revise the abovementioned targets.

Most of my assumptions are based on the following:

– past crypto market cycles

– increasing retail and institutional adoption

– ongoing growth in the number of unique wallet addresses

– improved tech (Proto-Danksharding and L2s have helped massively) RE throughput/scalability and Tx fees vs 2020/21

– Ethereum will also benefit from the AI crypto boom, DePIN and the eventual widespread adoption of real-world assets (RWAs).

– the gradual implementation of chain and account abstraction to significantly improve UX

– tokenemics (EIP-1559, a.k.a. London Hard Fork) has helped keep ETH’s total supply at ~120M since The Merge, courtesy of coin burning.

– The successful transition to the Beacon Chain (PoW -> PoS) as part of The Merge.

1) Spot ETFs for the leading altcoin

The US SEC allowed ETF providers to list the leading altcoin for spot trading four months after the regulator permitted companies to list BTC on the NASDAQ and NYSE.

In addition to the Fourth Bitcoin Block Reward Halving in April, these two events have caused bullish sentiment to return to this space.

Even though Ethereum (ETH) has yet to establish a new all-time high – unlike Bitcoin (BTC), which eclipsed $69,000 a month before the halving, which usually occurs after the event – it will most likely happen in the coming months if previous cycles are anything to go by.

However, I’m all for giving people options. If there’s another reputable choice to gain exposure to this asset, then I’ll welcome it…provided it doesn’t negatively impact each network’s decentralisation and overall security. This is a whole article in itself.

As a reminder, both BTC and ETH have done exceptionally well since launching, and I doubt either digital asset would have required ETFs to continue their trajectory.

2) Ongoing coin burn

While Ether does not have a specified hard cap like the 21M BTC max supply, the launch of EIP-1559, a.k.a. the London Hard Fork, in August 2021 has led to over 4.4 million ETH (~$16.5 billion) permanently burned. This is akin to BNB’s quarterly burns.

The release of this Ethereum Improvement Proposal (EIP) led to changes in how gas fees are calculated, which are required to carry out operations on Ethereum’s blockchain.

Gas consists of base and priority fees, with the latter playing a key role in incentivising validators to process your transaction faster than others, like various aspects of society.

In regards to the former:

The base fee is calculated independently of the current block and is instead determined by the blocks before it – making transaction fees more predictable for users. When the block is created, this base fee is “burned”, removing it from circulation.

Ethereum Docs > Gas and Fees

This setup stabilises the inflation associated with staking rewards for many other cryptos that lack the burn mechanism.

For example, ETH’s circulating supply has plateaued at around 120M coins since September 2022, when the network fully migrated to its proof-of-stake system (the Beacon Chain) as part of The Merge.

3) L2s, Proto-Danksharding and further scalability in the works

Another major change since the last (2020-21) bull cycle was the release of Proto-Danksharding (officially EIP-4844: Shard Blob Transactions). This has led to significantly cheaper transactions on Layer-2 scaling solutions that operate on top of Ethereum, which has also benefited the base chain with less network congestion, translating to lower gas fees.

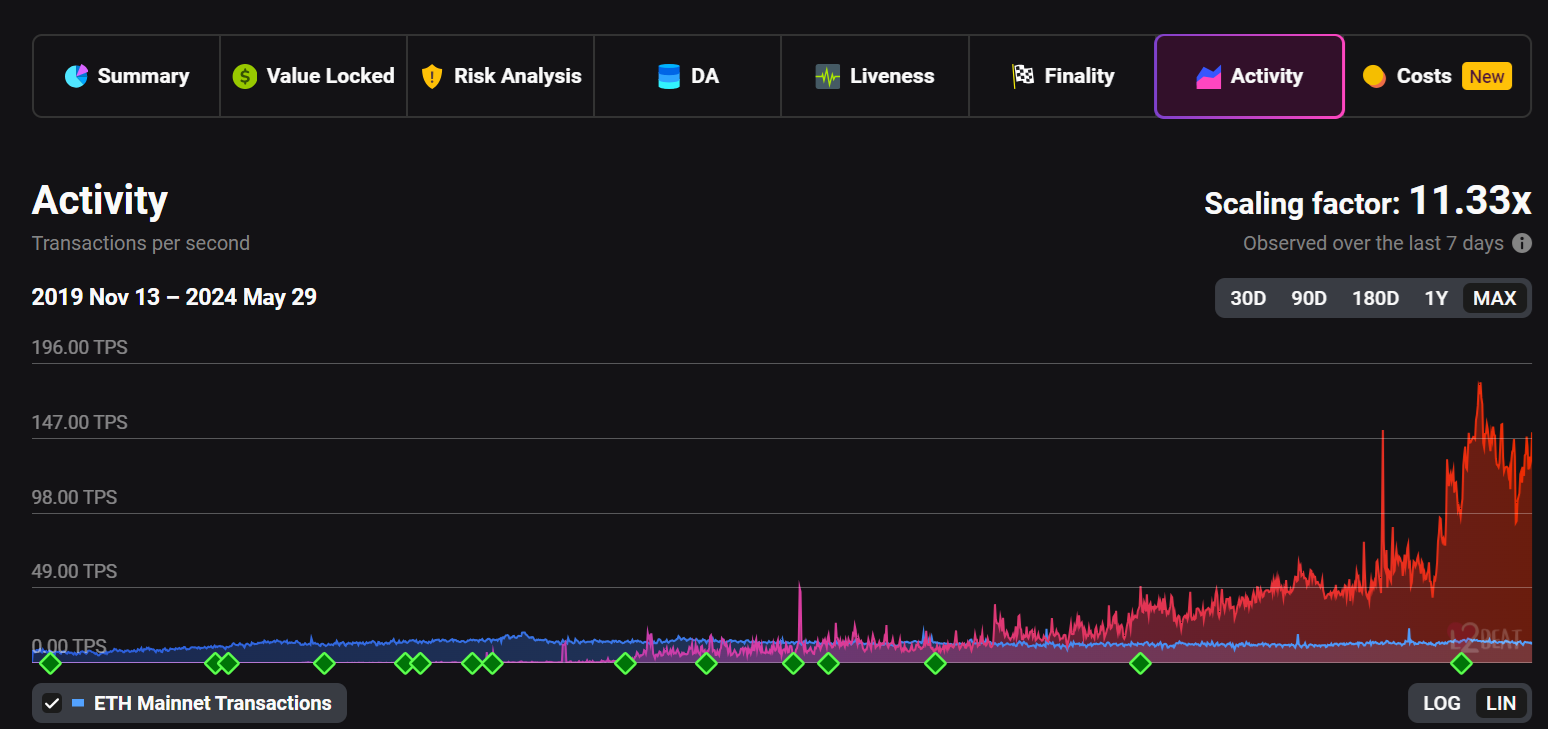

Combined Ethereum (L1) and L2 transactions per second. The last green diamond represents the introduction of Proto-Danksharding, which has also led to an 85-90% cost reduction per transaction. Source: L2 Beat

Ethereum devs’ deployment of this upgrade in the lead-up to a bull market in full swing was excellent timing. By the time a frenzy returns to this space, and people begin FOMOing back into it—akin to the NFT and play-to-earn mania in 2020-21—the L2s will do enough heavy lifting to avoid astronomical prices for NFT and ERC-20 token swaps.

Those who were around for that bull market will remember reports of people forking hundreds of dollars for just one swap. Uniswap (UNI) token holders would have been very happy campers during that period.

Moreover, what’s even better this time around is that many (ERC-20) tokens that were exclusively available on Ethereum now have contracts on other L1s, such as BNB Chain, Solana and Polygon (the latter being a sidechain, not an Ethereum L2).

This means there’s an alternative to consuming excessive amounts of ETH (expressed as gas, i.e., gwei) when swapping it for a token via a decentralised exchange (DEX), which is often required when you’d like to buy a digital asset that’s unavailable on a centralised exchange, e.g., Coinbase, Binance, Kraken.

There will still be higher average gas fees, but I am almost certain we won’t see anything as bad as last time. Calling that situation nonsensical would be an understatement.

————————————————————————————————————————

EIP-4844 is part of the quest to make Ethereum a truly scalable blockchain, which would allow it to overcome the blockchain trilemma.

However, it still hasn’t won the race. The blockchain that will triumph in future will be one that can maintain “sufficient” decentralisation (open to interpretation) and robust security and network reliability whilst being scalable…consistently achieving the holy grail of 60,000 TPS.

The recent EIP upgrade has made a notable difference in the short term, but Danksharding will be the main event that will take Ethereum to the next level.

Unlike many chains that have come and gone since it hit the scene in 2015, Ethereum has delivered many of its promises and made progress.

“Danksharding is how Ethereum becomes a truly scalable blockchain, but there are several protocol upgrades required to get there. Proto-Danksharding is an intermediate step along the way. Both aim to make transactions on Layer 2 as cheap as possible for users and should scale Ethereum to >100,000 transactions per second.”

Ethereum > Danksharding

As shown in the L2 Beats chart above, despite inroads made courtesy of L2s, Ethereum manages a paltry ~150 TPS and only around 15 TPS if you count its base chain. This is far from being considered “The World Computer”.

Nonetheless, I remain optimistic and believe the leading smart contracts platform has a long way to go.

Additional thoughts

The days of 30 – 50x gains within a 12–18-month period are long gone. Still, it will most likely remain profitable, particularly with the added sweeteners of staking rewards and a (slightly) deflationary supply.

The historical price chart below illustrates how far Ether has come, reflecting its blockchain’s success shortly after it hit the scene.

ETH/USD historical price chart (logarithmic). Source: CoinMarketCap

How likely is $16,000 within this bull cycle? Despite the diminishing returns per cycle, Ethereum shows no signs of stopping, and I believe this is a plausible target shortly.

Considering the current supply, this would translate to roughly $1.85 trillion in circulating market cap. For context, BTC has a $1.3 trillion circulating market cap.

The longer BTC, ETH and the rest of this nascent asset class stick around and manage to weather the constant storms and mudslinging over the years, the stronger these assets become, notably the top two.

Looking at the bigger picture, its recent approval to join BTC for spot trading on stock exchanges bolsters its reputation as an attractive asset and protocol for institutional adoption, not just retail.

One of Ethereum’s biggest drawcards in this regard is the Enterprise Ethereum Alliance, an international consortium of “blockchain leaders, adopters, innovators, developers, and businesses.”

Launched in February 2017, the EEA now has over 60 members, with renowned companies such as Accenture, Banco Santander, BlockApps, BNY Mellon, CME Group, ConsenSys, Intel, J.P. Morgan, and Microsoft sitting on its rotating board.

Several blockchains claim to have hundreds of partnerships, but these are mostly small to mid-sized companies valued at a fraction of the above-mentioned multinational corporations.

In conclusion, always be mindful of competition in this space, particularly with the vast amount of interest in Solana and its positioning itself to be one of Ethereum’s biggest rivals, which could generate higher returns this cycle, even though I still prefer the latter, as I outlined in a piece earlier this year.

When it comes to crypto, expect the unexpected and enjoy the ride; just don’t let it overwhelm you, as it gets rather hectic in the thick of the bull run.

https://cryptowithlorenzo.medium.com/why-solana-will-be-more-profitable-than-ethereum-6538fce965a3

P.S. Something I almost forgot to mention (consider this the best one till last) is the thousands of dApps and ERC-20 tokens that run on the biggest smart contracts platform.

Even though Solana, Cardano, Polygon, Polkadot and other L1s have provided alternatives to Ethereum – particularly since the last bull market – the latter still tops the charts for various metrics, i.e., total value locked (TVL), 24-hour volume, daily and monthly active users, etc.

Further reading and additional resources

ttps://medium.com/@cryptowithlorenzo/why-solana-will-be-more-profitable-than-ethereum-6538fce965a3

https://medium.com/p/12a29aa03979

https://medium.com/@cryptowithlorenzo/why-you-should-be-paying-attention-to-origintrail-c5bd9739460c

https://cryptowithlorenzo.medium.com/you-think-bitcoins-price-is-too-high-read-this-773b2d30955b

Ways to support my work

• Check out this post for various affiliate links and promotions you can use to top up (or kick start) your crypto portfolio. By using these, I earn a small commission at no extra cost to you.

Disclaimers

N.B. None of this is financial advice. I am not a financial advisor. You are ultimately responsible for your (investment) decisions.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your own research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

- Information is correct at the time of writing.

Featured image by Net Vector at Shutterstock

———————————————————————————————————————-

Originally published at https://www.cryptowithlorenzo.com.