Even Those in the Crypto Space

Most people entering the crypto space, particularly noobs, focus solely on the price of Bitcoin (BTC), Ethereum (ETH) or their favourite altcoin/token compared to a fiat currency such as the USD.

Whilst this is still a good indicator of how crypto has performed over time, another group of asset pairs tends to get ignored unless you’re a savvy trader or have been in this space for a while.

Crypto-to-crypto trading pairs.

BTC vs ETH gains the most attention, but in 2023, courtesy of a plethora of (centralised) exchanges and a vast swathe of decentralised exchanges (DEXes such as Uniswap, dYdX and PancakeSwap) have opened up over hundreds of thousands of trading pairs*.

*Sounds farfetched, but it is plausible with over 26,000 reported crypto assets (including stablecoins).

Why is this important?

There is the age-old debate in the crypto sphere surrounding how much Bitcoin and/or Ethereum you should hold, specifically:

1 BTC or 32 ETH?

While owning either amount in USD is out-of-reach nowadays for most people accumulating crypto over time, some savvy traders profit from regularly buying and selling their preferred crypto to boost their USD balance.

Such crypto-to-crypto pairings are important as they help gauge the relative performance of one compared to another decentralised digital asset, as opposed to fiat or a fiat-backed stablecoin.

However, the alternative that more people should consider is taking advantage of BTC vs ETH fluctuations, paying attention to crypto regulations and news from the US (which, in my opinion, has a disproportionate effect on this space, despite BTC and ETH being global assets); looking at macroeconomic trends (fiat inflation rates, stock-market performance, unemployment rates; debt-to-GDP ratio) + geopolitical tensions, crypto bans outside of the US, etc.).

Even though there has been more stability in the ETHBTC pair (and vice-versa) since mid-2021 versus 2017-2019, it is still worth paying attention to this pair.

This also relates to BTC dominance across the crypto market; on this note, you should also frequently note the percentage market-cap dominance of the top 10 crypto assets (excluding stablecoins) to help you gauge an asset’s strength over time.

ETHBTC pair all-time chart. Image using Coinbase data (via TradingView). Screenshot taken on 10 July 2023.

FYI, my take on this is to aim for half of each instead of one or the other, as I would refrain from putting all of my eggs into one crypto basket. As always, you do you.

Final thoughts

Another set of crypto pairs to watch in the coming months (perhaps weeks) will be any crypto-to-crypto chart involving XRP, as the Ripple vs SEC lawsuit is (widely considered to be) in its final stages.

I expect significant growth in XRP’s price shortly after the end of the lawsuit, as it has been subdued by this drawn-out lawsuit, despite forging multiple partnerships worldwide as of late.

When calculating ETH’s performance relative to BTC or any other crypto, we should also consider the annual percentage yield (APY) associated with staking, let alone for any crypto pair associated with ETH.

I am specifically referring to liquid staking derivatives (LSDs) such as Lido (stETH) and Rocket Pool (rETH) — readily-tradable ETH-related tokens whereby their prices are pegged to Ether, or even higher, like rETH in recent months. This is another source of passive income I have previously covered, requiring less effort than regular ETH trading.

In conclusion, growing mainstream adoption and acceptance of crypto as a legitimate asset class (particularly BTC, ETH and, to a certain extent, XRP), coupled with a weakening USD dominance in recent years, will gradually make crypto-to-crypto trading pairs more popular.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are solely responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs and other product affiliated with this space.

- For transparency, BTC and ETH collectively represent about half of my crypto portfolio.

Featured image by DUSAN ZIDAR on Shutterstock.

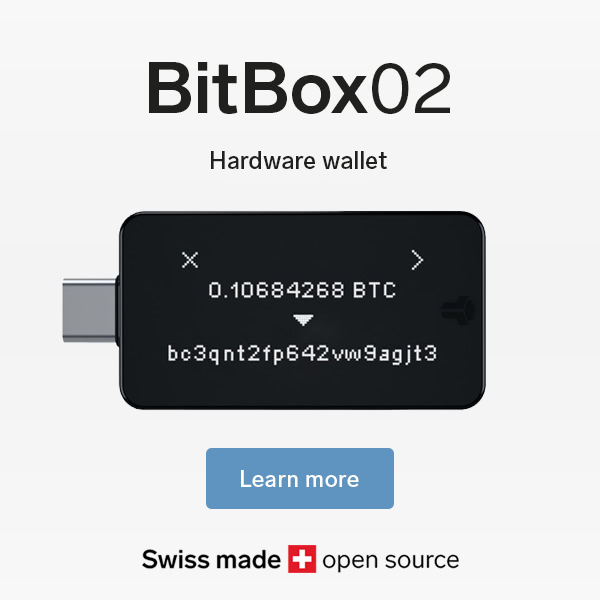

Affiliate link is included below. I receive a small commission per referred sale at no extra cost to you.

BitBox is an increasingly popular alternative to Ledger and Trezor hardware wallets.